Home ownership is a beautiful thing. There’s amazing freedom in knowing you own your space and that you don’t have any monthly obligations on your home other than utilities and property tax.

Sadly though, full debt-free home ownership is not the norm. Only 1/3 of all people who “own” houses are actually mortgage-free.

That means we’re overestimating true home ownership by quite a bit; do you really own it if the title goes to someone else if you stop your payments?

Admittedly I’m in the 2/3 that have a mortgage, but I’ve come up with a plan on how to kick that as fast as I can.

One of the biggest challenges in paying off mortgages is the timeline. Most standard mortgages carry a 30-year term.

Since the average age of a first-time home-buyer is 33, a good portion of people buying homes don’t pay off their mortgage until they are 63. What does that mean?

A good percentage of people don’t eliminate their single biggest monthly expense until just 2 years before they retire

And that’s if they live in the same home (or cheaper) for the rest of their lives. With how often I hear the term “starter home” and the phrase “our place is a little too small”, I have trouble believing that’s the case.

How do we ever get out of this mess?

The Mind-Hack: Pretend You Never Get a Raise

Here’s the plan: every time you get a raise, don’t change your budget to include the new money. Set up your budget as if you never got a raise and instead put that new money every month into prepaying your mortgage. Sound crazy? Maybe, but the results are astonishing.

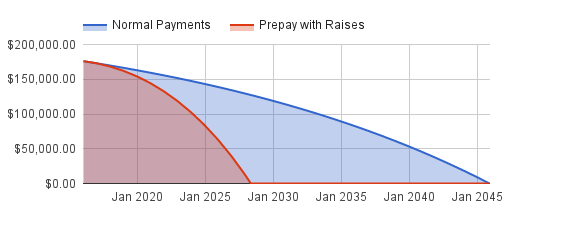

If you follow this strategy, you can pay off a 30 year mortgage in 12.4 years. Seriously. Don’t believe me? Here’s a chart of remaining principal between the two methods:

The other benefit

Not only do you pay off your mortgage almost 18 years faster, you also save a ton on interest. Because you are prepaying your mortgage (which all goes to paying down your principal balance), the interest portion of every normal payment after has less interest included. How much do you save?

By pre-paying with raises over the full period of your mortgage, you end up paying $68,773.70 less for your house than if you didn’t

That’s right — almost $70 thousand dollars.

Does it apply to me?

All the math above is assuming:

- A home price of $220,300 (the USA median in Nov 2015 via St. Louis Federal Reserve)

- A 30-year mortgage of $176,240 at an interest rate of 4% (total is 80% of the home price, rate from bankrate.com on Jan 15, 2016)

- Based on this, the normal mortgage payment is $841.40 per month

- A household income of $56,746 (the USA median in Nov 2015 via Advisor Perspectives)

- A yearly wage increase of 3.36% (the USA annualized average from 1990–2014 via Social Security Administration)

- Federal, state, and Social Security/Medicaid taxes totaling 28.65% (15% federal, 6% state, 7.65% social security/medicaid)

How does it work?

The power here is in the compounding and cumulative effect of each new year’s raise on top of all the raises before.

In the first year, you’re not pre-paying anything.

In the second year, you get your first raise, bumping your take-home pay by $113.37 per month. Add this up over the year and you get an extra $1,360 paid down on your mortgage by the end of the second year beyond your normal mortgage contributions.

In the third year, you get another raise bumping your take-home pay by $117.17 per month. Since you were already contributing $133.37, add those two and now you’re putting $230.54 extra each month into your mortgage.

By the last year, you’re making $1,642.21 more per month than you were in the first year. At this point, your prepayments are quickly finishing out the remaining principal you owe.

If you want to see the fancy spreadsheet that did all the math here, you can find it on Google Drive here: Mortgage Paydown with Raises

Variations on a theme

So, what if your family makes less than the median? Or what if your raises are smaller?

No matter what, the impacts of using your raises to pre-pay are big:

With half the income ($28,373), you pay off the mortgage in under 16 years and save just over $55,000

With only a 1% annual raise, you pay off the mortgage in under 19 years and save almost $43,000 With half the income ($28,373)and only a 1% annual raise, you pay off the mortgage in just over 22 years and save over $29,000

Even if your household income is half the median and you just get a 1% per year raise on average, you can still knock 8 years off your mortgage and save $29,000 in interest payments

A mortgage-free future

Once that mortgage is paid off, a family in the original situation above would have an extra $2,483.61 each month based on the money that was previously being committed to mortgage payments and prepayments. That’s $29,800 a year that you have the burden of figuring out what to do with.

Perhaps even better, you’ll have honed your financial discipline at this point to be able to thrive without needing that money.

What would you do with an extra $30,000 per year?

Imagine the nest egg you can build up for retirement (maybe even early retirement).

But what about…

You might be thinking about inflation — how can you possibly forego your raise? When raises only roughly match inflation, doesn’t that mean you need them? I’d argue that we can all be smarter about our spending.

Using this plan forces you, in real terms, to find ways to whittle down your spending year-over-year because you’re going to spend the same $35,000 next year as you did this year despite the fact that the cost of a carton of eggs (and everything else) is going to go up by 3%.

Be disciplined

This takes discipline — you have to be willing to push outside your comfort zone. Consider buying your next pair of workout pants from a thrift store.

Stretch yourself to cut 10% out of your grocery bill by checking the price of competing brands. Every little change counts and adds up, but you have to stay diligent.

There are tons of people out there with great ideas on how to spend less — start following them and join those of us that are pursuing financial freedom.

Some of my personal favorites; most of which are fairly holistic (how to live a better life) and incorporate great advice that will bring your spending down.

- Mr. Money Mustache — perhaps the biggest single influence on how I approach money today

- The Art of Simple

- Becoming Minimalist

- Tim Ferriss

It’s not necessarily going to be easy, but you’ve got a lot of others out here supporting you. I know you can do it if you leverage the resources you’ve got and stay disciplined.

If you’d like to plug your own numbers in and see what using your raises for pre-payment can do for you in your mortgage, I created a Google Drive spreadsheet you can get your own free copy of.

Just click the link below, sign in to Google and confirm you want to create your own copy of the sheet. Get your own copy here: Mortgage Paydown with Raises

If you want help staying disciplined and keeping a continuous focus on minimizing your spending, I created a tool to help you do just that.

Track all your spending purchase-by-purchase so you know where your money is going. Then pick a category to improve on and watch your progress. Are you ready to get Thrifty? Head to Thrifty to try it out!