How much money does an extra day of financial freedom cost? While it seems like a pretty cool philosophical question, there’s actually a way you can calculate it to the penny. Get ready for the theory, the math, and the free calculators to give you a personalized quote on the cost of a day of freedom.

Catching up on some podcasts recently, I was amped to see a new episode of the Mad Fientist podcast with three amazing guests - Mr. Money Mustache, Paula Pant from Afford Anything, and Doug Nordman from The Military Guide. This was an open Q&A session from Camp Mustache earlier this year.

It’s not often you get to hear a lineup like this all at the same time, so I dove right in. Partway through, someone asked how the panelists kept motivated while working toward financial independence (FI) and Mr. Money Mustache (MMM) responded with this (cut down for readability):

I was kind of like jumping down the stairs at the end of each work day zigzagging down to where I parked my bike. I remember thinking, “Okay, that’s another $400 or whatever…” — and I would calculate how many more weeks closer I’d pulled in my retirement because, by that time, $400 earned that day, I wasn’t going to be able to spend until 20 years in the future, so it would’ve compounded to thousands of dollars.

So, anyway, I was like, “Yeah, I just subtracted another 39 days from my work life.” Little mental games like that just made it feel like I had accomplished a lot in one boring day.

Whoa

It’s a cool thought - correlating the impact your day at work has on your retirement.

It’s one thing to think about this; it’s another thing to actually calculate it. (Tweet this )

With my addiction to spreadsheets, I took some time to figure out the math and put together a spreadsheet to figure out what the impact of an extra day or an extra dollar is.

I translated these back into a couple web-based tools below that you can use - feel free to put your own numbers in and see how it turns out!

Calculating Retirement Days Earned

How Much FI Time Can You Buy?

Note: because this is trying to look just at the impact of a set dollar amount now, this assumes that you don’t plan any other contributions to your retirement savings in the future

The cool part is that you can then use this in the MMM example of understanding how much retirement time you bank for every day you work by simply plugging in the amount you put into retirement savings for each work day

Calculating the Price of a Day (or Year)

What's the Price for FI Time?

My Numbers

The most fun part for me here was to crunch my numbers and see a few things:

- If I stopped contributing to my retirement accounts right now and didn’t ever put another penny in, I’d still be able to retire at age 68 and 8 months

- For every day of work, I bank 3.1 days of retirement just based on 401k contributions (mine and company match). When you throw in our current additional savings from take-home pay, it goes up to 6.3 days banked per day worked

- For the low price of $24.47, I can buy a day of retirement

I can buy a day of FI for $25 (Tweet this )

Now, every time I have something that comes out to a $25-30 expense, I’m going to have this running through my head. I hope it becomes a motivator to make good trade-offs on a day-to-day basis.

Next step is to find some $25 things to forego and invest the money instead so I can start pulling that date in beyond what working will already do :)

On the grander scale, the cost of an extra year of FI at this point in my journey would be $9,175.61

General Rules

Playing around with the calculators, there are some interesting truisms that surface:

- The earlier you are in your FI journey, the bigger the impact. If you’ve got $30,000 in retirement accounts today, you can buy an extra day of retirement for $5; a whole year only costs $1,878.

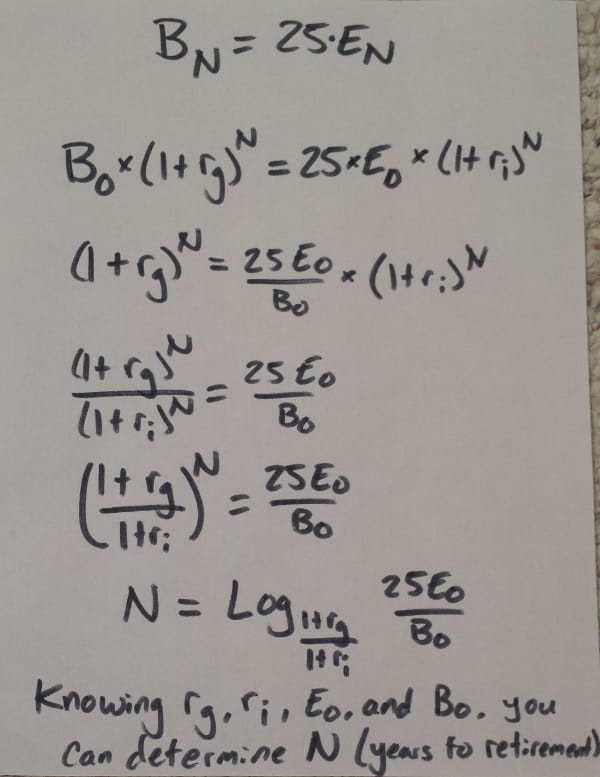

- Notice (strangely) that we can do all this math without even knowing what your expected expenses are in retirement. While it may seem counterintuitive, the math backs it up (see below).

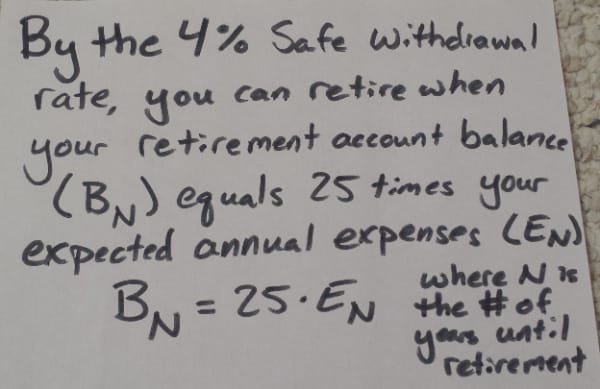

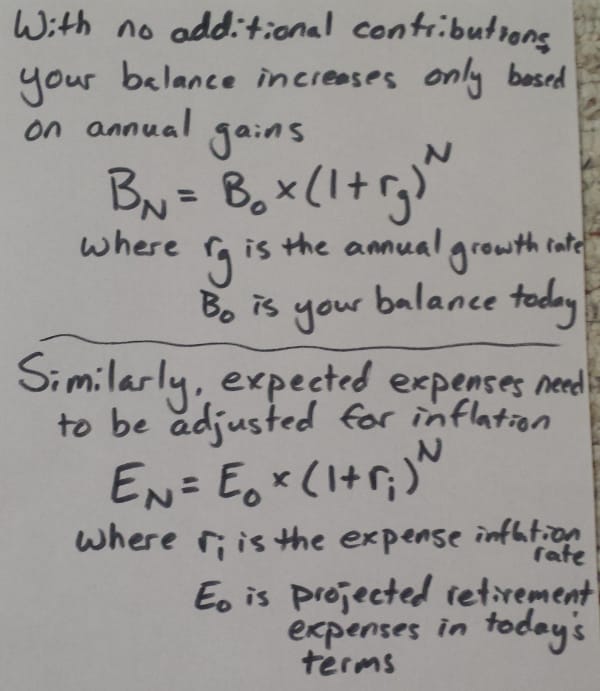

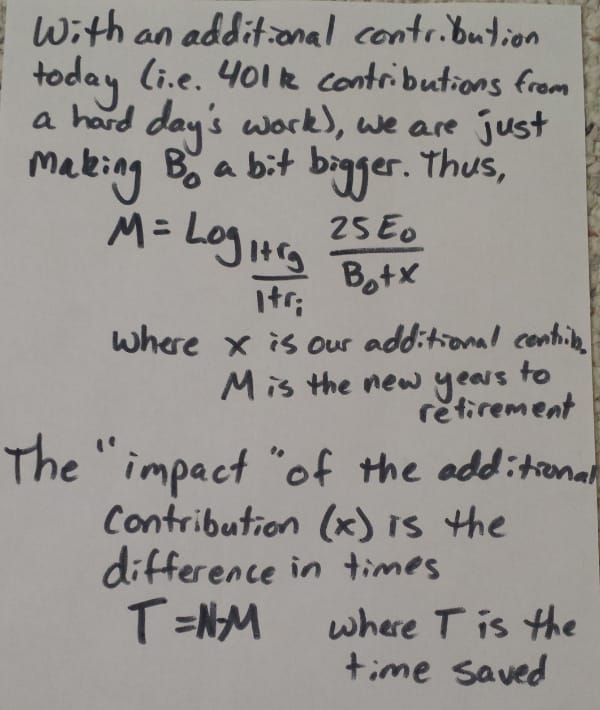

The Math Behind the Tools

If you’re not interested in seeing the math that backs up the calculators, skip to the bottom for an announcement related to this post and a teaser of what’s coming up soon. In addition, you can leave a comment, share the post, or subscribe to my e-mail list so more awesomeness like this just magically appears in your inbox!

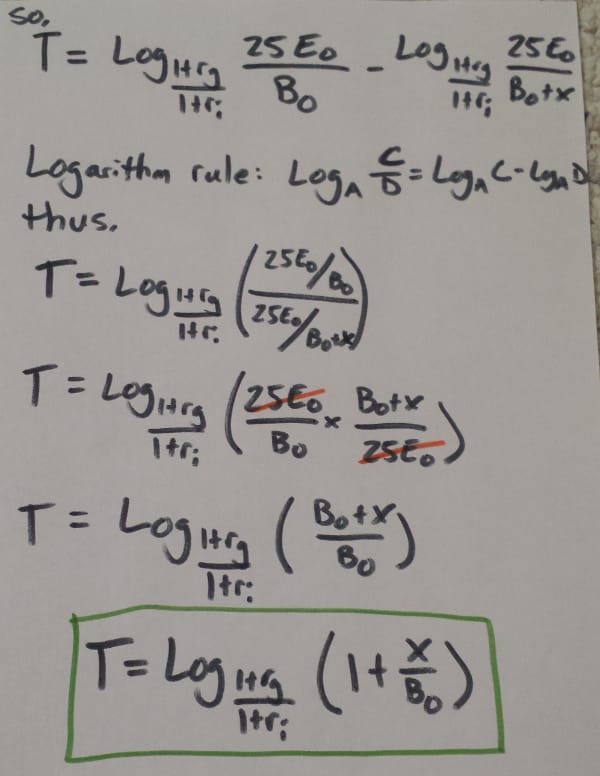

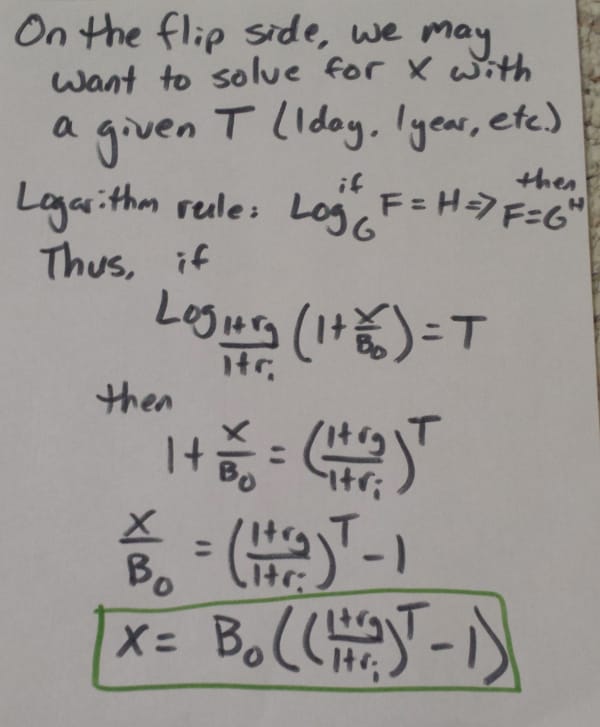

For the mathematical masochists, check out these images of the math I used. It felt like a return to middle and high-school math for me to go through this but it was fun to actually figure things out.

I apologize for the poor quality; I had to do this on paper and take pictures to upload them. Formulas like this on a webpage just make it feel too much like a textbook if they are typed out.

Someday I’ll have an awesome whiteboard in our house and I can make these kinds of presentations prettier :)

Did you ever think you’d use logarithms again?

I definitely had to look up some of the logarithm rules to simplify the equations :)

Spreadsheet Teaser

For the spreadsheet fanatics out there, I’ve got a treat for you. Next weeks post will revisit today’s topic and we’ll go through putting all of this in a spreadsheet. I’ll show you from scratch how to take these simple calculators and juice them up with graphs into a nice little dashboard. Check out the Price of a Day of Retirement Spreadsheet Guide now!

What’s a Day Worth to You?

You’ve got the tools now to figure it out - what’s a extra day of FI cost you? Can you find a regular expense around that amount that you could eliminate?