If you’re going to commit to paying hundreds of thousands of dollars on something, shouldn’t you understand the math involved?

I’ve been wanting to write a post about our “mortgage journey” and how we’re on-track to save $160,000 on our mortgage through some powerful tactics.

As I got started on that one, I realized that I didn’t have a resource to point readers to in case they weren’t comfortable with the math behind mortgage principal and interest.

So, this post is the fix to that - this should help you understand the math behind mortgages so you can be a savvy consumer :)

As a case example, we’ll use the first mortgage we got on our house so you can see the numbers in action.

Disclaimer: If you are either super comfortable with the math behind mortgages or have absolutely no interest in understanding how principal and interest are calculated, feel free to skip this post and keep an eye out for the next one :)

What is a mortgage?

In the simplest words, a mortgage is a loan you take out to help you pay for a house.

In exchange for the big pile of money you get to put toward buying your home, you commit to making monthly payments to your lender until the loan is paid in full.

Each normal payment includes an interest payment (the money you give the bank that makes the loan worth their while) and a principal payment (money that actually decreases the amount you owe the bank).

Over the life of your loan, you keep making payments to decrease the amount you owe the bank and once you’ve paid the bank off, you’re done.

Important note about mortgages

While you’ve got a mortgage, it’s important to remember that you don’t fully own your house.

When you buy with a mortgage, the lender gets a “lien” against your house, which is a fancy way of saying that they can take possession of your home if you fail to make your payments.

While only 1/3 of all people who “own” houses are actually mortgage-free, I don’t run my life with the goal of being like the majority - I’m a big fan of being 100% debt-free.

“Debt” is a synonym for “obligation” and I don’t want to have to be financially obligated to anyone if I can help it :)

With that in mind, let’s take a look at the components of a mortgage and how they all work together to define your obligation to the lender.

Fundamental components

Purchase Price

This is the total amount you give to the seller or builder to buy the home.

Our purchase price was $219,900

Down Payment

When you purchase a home, it’s very unlikely you’ll borrow the full amount to cover the purchase price.

To ensure that you’ve got some skin in the game, banks typically require some amount of up-front money on your end.

This up-front money is called a down payment, which is usually represented as a percentage of the actual purchase price.

Common down-payment amounts are 3%, 10%, and 20% of the purchase price.

A few important notes here:

- A bigger down payment decreases the size of your loan; this will decrease the total amount you pay out-of-pocket after you factor in interest

- A bigger down payment often gets a lower interest rate; this also decreases the total amount you pay out-of-pocket

- If you put in less than 20% of the purchase price for the down-payment, you are usually required to pay for private mortgage insurance (PMI). PMI is insurance for the lender in case you fail to make your payments.

I don’t know about you, but I don’t especially like the thought of paying for someone else to be insured against my behavior.

With that in mind, I recommend saving up until you’ve got a 20% down-payment :)

Our down payment was just over 20% of the purchase price - $44,000

Loan Amount

The loan amount is the actual amount of money you borrow from the bank, which can be computed as:

Loan Amount = Purchase Price - Down Payment

Our loan amount was $175,900 ($219,900 - $44,000)

Interest Rate

Interest is the money the bank charges you for the right to have the loan.

Interest is commonly expressed as an annual interest rate usually in increments of 0.125% (an eighth of a percent).

The rate stated on mortgages is usually an annual “non-compounding” rate.

That said, most mortgage calculations are done on a monthly basis (i.e. for a monthly payment), so you’ll sometimes see this get divided by 12 to get a monthly rate.

Note: if your mortgage is quoted with an “APR”, this is NOT the annual non-compounding rate; see if you can find the non-compounded rate in the documentation (typically something just a bit lower than the stated APR).

Our interest rate was 6.625%

Type

Mortgages come in lots of flavors, but the three major types are:

- Fixed: the interest rate at the start of your loan stays the same for the full duration of the loan

- ARM (Adjustable Rate Mortgage): typically expressed in terms like “5/1” or “10/1”, the interest rate is locked in for the first 5 years or 10 years (respectively) and then is updated each 1 year after that

- Interest only: you pay only for the interest in your normal payments - you don’t pay down the amount you owe. Buyer beware - that means you don’t own any more of your home after 1 year of payments than you did at the start!

ARMs and Interest only mortgages are well beyond “Mortgage Math 101” and carry different risks, so let’s leave them for another day.

Thankfully, our mortgage was a fixed mortgage

Term

The term is the amount of time over which you will pay the mortgage if you make normal mortgage payments. Typical terms for fixed mortgages are 10 years, 15 years, 20 years, or 30 years.

Because mortgage payments are usually paid monthly, you’ll sometimes hear terms expressed in months instead.

Our term was 30 years (360 months)

Our mortgage structure

In summary, our mortgage had the following components:

- Purchase Price: $219,900

- Down Payment: $44,000 (20%)

- Loan Amount: $175,900

- Interest Rate: 6.625%

- Type: Fixed

- Term: 30 years

Basic Mortgage Calculations

Now that we’ve got the basic terminology sorted out, let’s look at how everything works together.

What Happens With Each Mortgage Payment

Every month, you make a mortgage payment that the bank divides into two buckets:

- Interest payment (the cost of having the loan)

- Principal payment (reducing the amount of money you still owe the bank)

The money is divided based on these formulas:

Interest Portion = Outstanding Principal x Mortgage Rate / 12

Toward Principal = Total Payment - Interest Portion

This interest portion is where you see the annual rate get converted into a monthly rate by dividing by 12 as we talked about in the interest section above.

Example - Our First Payment

For our original mortgage, we had a payment of $1126.31 per month. In the first month, that works out to:

Interest Portion = $175,900 x 6.625% / 12 = $971.11

Toward Principal = $1126.31 - $971.11 = $155.20

Take a second look at those numbers. No really, I mean it - look at them again.

In the first month, less than 14% of what we paid actually went to paying down the amount we owed the bank. Stings, doesn’t it?

Example - Our Second Payment

With our first payment, we dropped our outstanding mortgage by $155.20 to $175,744.80; then the next month looks like this:

Interest Portion = $175,744.80 x 6.625% / 12 = $970.26

Toward Principal = $1126.31 - $970.26 = $156.05

Note that the amount going toward principal is a bit higher in the second month - from $155.20 to $156.05.

Over the life of your loan, the proportion of each payment applied to principal (the good stuff) increases every month.

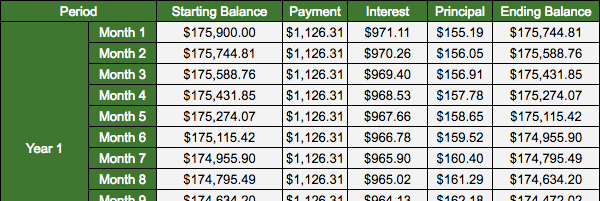

Amortization Tables

I’ve shown you months one and two but with a 30 year mortgage there are 360 months of payments. I’m pretty sure you don’t want each one listed here in the post, so we need another option.

One way that you’ll commonly see mortgage information organized is in something called an “Amortization Table”, which shows the above math for all 360 months in a neat little table:

To take a peek, here’s a Google Drive spreadsheet with the amortization table for the mortgage we’ve been looking at: Amortization Calculator

I set up the sheet so you can copy or download it and input your own mortgage terms. Happy number-crunching!

Take note of the total payment

If you go into the calculator, you’ll notice one important number summarized near the top - “Total Interest + Principal”.

This number shows how much total money you’ll pay over the life of the loan when you include all of the principal and interest payments.

As you can see, for a roughly $176,000 loan, you’re paying $405,000. Sure, it’s spread out over 30 years, but that’s quite the mark-up!

This is the reason that I’m so passionate about paying down debt - that’s $229,000 in interest I could be doing something else with if I can find a way to get some of it back.

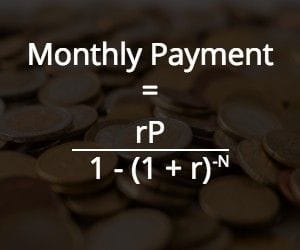

How did we calculate the monthly payment?

One thing I glossed over was how to calculate the monthly payment.

Admittedly, that was on purpose; the actual mathematical formula is a bit gnarly and I didn’t want to scare anyone off.

Here are three ways you can figure out what your mortgage payment is (in order from easiest to most complex):

Google it

Thankfully, there are lots of free mortgage payment calculators online. Google’s got a nice easy one here

Spreadsheet formula

Microsoft Excel, Google Drive, and other spreadsheet software give an easy formula to use compute a monthly mortgage payment:

=PMT(r / 12, N * 12, -P)

Where you replace each of the following with your actual number:

- r = the annual interest rate (in our case 6.625%)

- N = the length of the loan in years (in our case 30)

- P = the amount of the loan (in our case $175,900)

So, in our case, that’s:

=PMT(6.625% / 12, 30 * 12, -175900)

Manual calculation

If you’re a glutton for punishment, you can pull out a calculator and do the math manually with this formula (substitute the same as above).

Use any of these methods and you should be able to compute your monthly payment.

Your lender should provide this for you as well when you’re ready to take out the loan, but it’s always a good idea to independently check the math :)

So now what?

At this point, you should have a good understanding of where the numbers in your mortgage come from.

More specifically, you should understand how to figure out your monthly payment and how that payment gets broken down into principal and interest.

Now that we’ve laid the foundation, you should be all set up for my next post where I’ll show how we are on-track to save $160,000 on our mortgage through applying some cool tactics.

If you’ve got any questions, feel free to tweet, comment below, or e-mail me.

Stay tuned!