Have you ever heard that you shouldn’t prepay your mortgage because of what you’d lose out in mortgage interest deductions? It’s nonsense. I’ve heard this argument more than a few times and it’s finally time to put this baby to rest.

There are financial opinions and then there are financial facts. (Tweet this ) Knowing the difference and acting on the facts can be the difference between financial freedom and financial ruin.

This isn’t a question with variability. This isn’t a question that has to account for a volatile market or anything else. This is just simple, straightforward math.

So, with that in mind, let’s break this down so we can have the answer once and for all.

What is the Home Mortgage Interest Deduction?

The Home Mortgage Interest Deduction, as outlined in IRS Publication 936 identifies the situations under which a homeowner can deduct the interest portion of their mortgage payments in a given year.

If you’re fuzzy on how to figure out what the interest portion of your mortgage payments is, check out my Mortgage Math 101 post. As you progress through your mortgage payment, the proportion of each payment that goes to interest drops. Prepaying accelerates this, leading to less interest paid and, as such, less deduction to take.

This is where the argument comes in. I’ve heard it in various terms, but the most common is this:

“Man, you’re really going to miss that deduction once it’s gone.”

But will I? As a fairly rational number-cruncher, I won’t.

Let’s take a look why.

The Home Mortgage Interest Deduction is Like 25% Off Pants

What do you do when you’re at the mall buying a shirt and notice a sign for 25% off of $40 pants?

You didn’t need the pants, but man, they are on sale!

If you’re a good thrifter, you realize that 25% off is 75% on. If you buy a pair of pants that you don’t need, you’re not “saving” $10, you’re unnecessarily spending $30.

This is the right frame of mind to look at the “loss” of the mortgage interest deduction from prepaying your mortgage.

Let’s say that you were due to pay $4,000 in interest this year and could deduct it at a rate of 25%. That’s a cool $1,000 less in taxes you pay this year. Seems pretty awesome, right?

With that kind of a setup, you’re really only paying $3,000 this year ($4,000 in interest minus $1,000 for the lower tax bill)

What if you had paid off your mortgage instead, where would you be?

Instead of paying $4,000 in interest and saving $1,000 in taxes, you’d pay…nothing. No money to the lender and no kickback from the government.

So, the net effect here? Prepaying your mortgage would have saved you $3,000 this year.

The Total Impact

It’s fine to look at this in a single year, but really we should be looking to optimize our financial situation over the entire term of a mortgage.

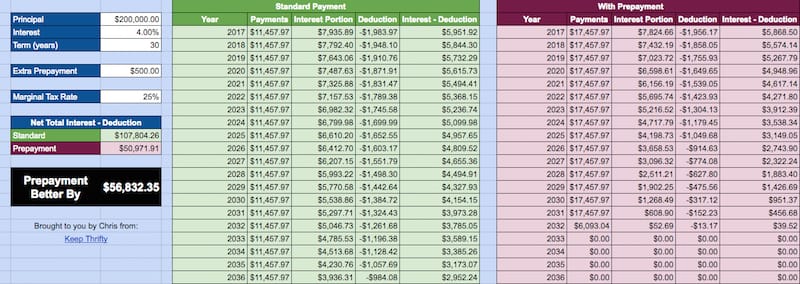

With that in mind, I created (surprise, surprise) a spreadsheet to do exactly that.

Check out the Home Mortgage Interest Deduction Comparison spreadsheet to check out the difference between the two. You can plug in different numbers and see how it all changes, but the prepayment scenario will always win out.

Is There Any Truth?

This all leads me to wonder where the original argument of “missing out on the deduction” comes from.

The best I can tell is that it’s from one of two sources - people misunderstanding the meaning of tax deductions (vs tax credits) or people trying to optimize their tax picture instead of their overall picture

Tax Deductions vs Tax Credits

A tax deduction is a government incentive that lets you reduce your taxable income.

If for example, you have a taxable income of $64,000 and can take a deduction of $4,000, your taxable income drops to $60,000. If your marginal tax rate (essentially the tax bracket you land in) is 25%, that’s a savings of $1,000 (25% times $4,000).

A tax credit is a government incentive that lets you reduce your total taxes.

Say, for example, you have a taxable income of $64,000 and a total tax for the year of $10,000. If you get a tax credit of $4,000, you only pay $6,000. Cha-ching!

Deductions are really nice. Credits are awesome. Got it?

The Home Mortgage Interest Deduction is exactly that - a deduction. And even if it were a credit, prepaying would just be the same total cost as not. It wouldn’t end up worse.

If you don’t believe me, go in the spreadsheet and change the marginal tax rate to 100% (which simulates the mortgage interest rate deduction changing to a credit). In that case, you’d pay $0 net interest on your mortgage.

In either case, prepayment isn’t worse, so the argument isn’t holding. What about people optimizing their tax situation instead of their overall situation?

Optimizing Taxes

I suspect this is actually where the root of this argument is - presuming that an optimized tax situation is an optimized financial situation.

For this, I’ll reinvoke the image of our 25% off pants sale but put it back in terms of the actual parties involved.

A picture is worth a thousand words, so here’s my expertly drawn comparison diagram:

For some people, it might feel great to “stick it to the man” and pay $1,000 less in taxes. The thing they’re forgetting is that the cost of doing that is you giving $4,000 extra to the bank.

I don’t know about you, but I’d much rather take that $3,000 difference and invest it :)

Prepaying is Better…in this Case

When purely looking at the implications of the home mortgage tax deduction, prepaying is a clear winner. That said, if you’re trying to decide whether or not to prepay, this shouldn’t be your only factor.

To get a true picture of prepayment, you should also take your risk tolerance into account and consider whether you’d be better off prepaying or investing.

Anyhow, next time someone tells you that you’re really going to miss your deduction when you’re done paying off your mortgage, you know where to send them. Keep the facts on your side and, as always, keep thrifty!

Any other nuggets you’ve heard in this argument? What other financial opinions have you heard put forward as facts?