There are lots of online mortgage refinancing calculators for “normal” people. Thrifty rockstars like you and I might feel a bit left out though because most calculators don’t include our particular situations. If you find that’s the case, my “Ultimate Refinancing Calculator” might just be what you’re looking for.

The Backstory

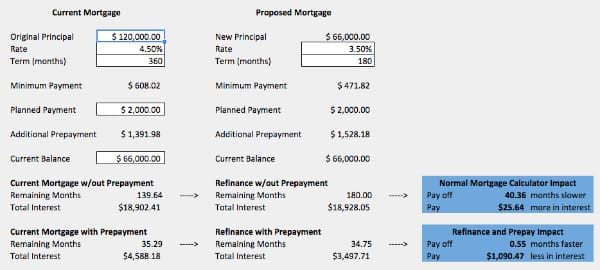

Last Thursday, a co-worker asked me for some advice on refinancing his house from a 30-year to a 15-year with a rate improvement from 4.5% to 3.5%. We crunched the numbers quickly and concluded that it was almost a no-brainer, saving him over $5000.

Later in the day, I realized we had done all the math using “normal payments” - presuming that he’d apply his current minimum payment (around $600) for either mortgage.

For most people this wouldn’t be an issue, but my co-worker has been doing a phenomenal job prepaying his mortgage well above that $600 a month amount and he plans to continue to do so.

Naturally, I whipped up a new spreadsheet to figure out what his numbers would look like with prepayments included.

With his high prepayments, the savings dropped from $5000 to $1000, roughly the amount of the closing costs.

Whoa - The decision went from an absolute yes to not worth the effort!

Why I Made My Own Calculator

Most online calculators assume you’ll adjust your monthly payment to whatever the bank computes as your standard payment for the term.

That’s just silly :)

If you can afford your current payment, why not keep paying the same amount after a refinance so you can get the added benefit of prepaying the difference?

Beyond this, most online calculators assume you’re not already prepaying.

Again - that’s just silly. If you’re a follower of this blog, you know I’m a big proponent of prepaying your mortgage.

A Keep Thrifty calculator would have to look at the world a bit differently (Tweet this )

- It should allow for prepayments in your current mortgage

- Presuming that your refinance drops your monthly payment, it should assume you’ll keep paying your current monthly amount (to keep the prepayment train rolling!)

With that in mind, I present the ultimate refinancing spreadsheet:

Enter the Dragon

I’ve got the spreadsheet available for free on Google Sheets. Click here to get your own copy

Here’s how to use it:

- On the Comparison sheet, enter in your current mortgage information in the white boxes in column C. This includes what payment you can comfortably afford each month. Do not include any escrow amount - just put the amount going toward principal and interest

- Enter the proposed mortgage terms in column D.

- Check out the results in the box on the bottom right

The calculator presumes that you’re not going to drop your monthly payment just because the bank tells you that you could pay less. By keeping your payment the same, you get the one-two punch of lower interest from the refinance and from the prepayments.

With these assumptions, the calculator will tell you how much faster (or slower) you’ll pay off the mortgage as well as how much less (or more) you’ll pay in interest.

You can also look at the Principal Remaining and Cumulative Interest charts to see the outcomes for each of four different scenarios:

- Paying off your current mortgage with your Planned payment

- Paying off your current mortgage with the Minimum payment

- Paying off the refinanced mortgage with your Planned payment

- Paying off the refinanced mortgage with the Minimum payment

An Important Lesson

Looking at the charts, the debt-destruction strategy becomes pretty clear.

Refinancing alone in many cases drops total interest costs by a respectable amount (either due to lower interest rate or shorter term). Prepaying alone also has a big impact on interest.

But you can do even better:

By refinancing and keeping the current payment you get the double-whammy of paying down even faster (Tweet this )

For the spreadsheet geeks out there, feel free to tweak the sheet to your heart’s content. If you have any questions, let me know!

Considering a refi? What impact does the calculator show for you?