This article contains one or more affiliate links. We only link to things we support and think you could find useful. If you pay for something you clicked on in this article, we may get a commission as a result.

Ready for another Keep Thrifty spending report? This time, we’ve got a treat for you. We’ve added two sections to amp up the fun - a side-hustle income summary section and a savings section. Ready to dive in? Let’s start with some personal updates.

Personal Updates

So, last month I mentioned that Wisconsin is known for wild weather swings. This month proved me right. On April 15th, we had a snowstorm. Two weeks later, the high topped 80 degrees. This state drives me nuts :)

Weather aside, we had a lot going on this month. We announced that we’re doing one more year of mini-retirement, spending this year trying to figure out two big things: where we want to live and how we’re going to make a living.

In all honesty, it’s been a roller-coaster. In many ways, it’s tough to figure out what we’re doing because the entire world of possibilities is open to us.

Do we move to Florida? Texas? Try to tough it out in Wisconsin with a healthy dose of annual travel?

I’ll say the snowstorm this month helped nudge things in the direction of moving, but our ability to move is inextricably tied to our ability to earn an income.

During my years with my old employer, I built a great network full of amazing people. Many of these people have reached out to me over the last year to talk about job opportunities. Every time one comes up, I’m torn on what to do.

I loved the people I worked with in my old company and the products we worked on. Going back there was never out of the question for me, but I wonder if there will be opportunities - especially for remote work (which we’d need if we were going to move to another state). In addition, I’d love to work as a full-time software developer, but the technologies my old employer uses are very different from the ones I’m now really enjoying working with.

I’ve been looking at some job listings for software developers - trying to figure out where my skillset lands me in the stack and how I’d stand out in resumes, cover letters, and interviews. I’m in a bit of a pinch - I have a fair amount of web development experience (between Thrifty and my new project, MNY), but it’s all been as a solo developer. I haven’t worked in a team with the more structured processes that come with multiple developers.

And MNY, my new project with Grant from Millennial Money, has a lot of promise, but it’s too early to tell how successful it’ll be. This could provide full-time income for me if we’re lucky, but we probably won’t know for another 4-8 months. That’s a lot of time when you’re trying to figure out your next home!

There’s a lot of uncertainty about what our life is going to look like a year from now and I internalize that all as stress. I have to keep reminding myself that God has a plan for us and that he’ll give us the answers when the time is right. It may not be what I want to hear, but it’s the truth :)

In the meantime, we’re going to keep praying, exploring, and hoping that God points us more clearly in the direction we’re supposed to go. Plus, with the weather getting warmer, we’re trying to get out and have some fun! One of our favorite things to do as a family is to get outside and explore nature, so we took advantage as best we could this month.

Finally, we celebrated our twins’ sixth birthdays this month! We gave in and agreed that they could have separate birthday parties, which is something they’ve never experienced. So, this last weekend, we celebrated twice - once at a roller skating rink and once at a pizza/arcade place. It was a weekend full of cake and laughter :)

Ok - I think that covers the big stuff; ready to look at our spending for April?

How We Track Our Spending

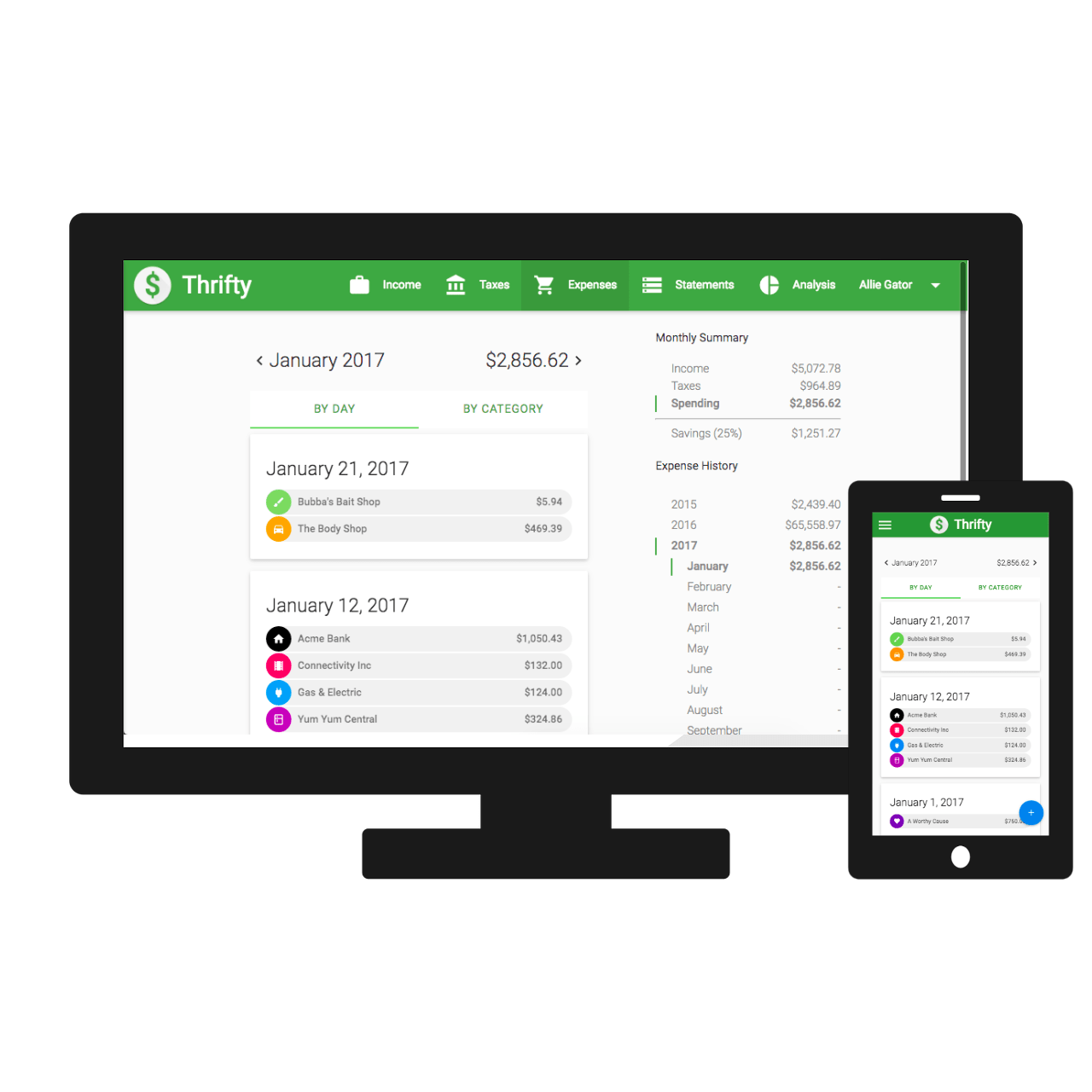

We’ve been manually tracking our spending for the last 2.5 years and it’s helped us make a big improvement in our spending habits.

I couldn’t talk Jaime into loving spreadsheets, so I created a web app for us instead. Once we had it for ourselves, it was a logical next step to put it online for anyone to access.

In the spending summary below, you’ll see screenshots straight out of our Thrifty account.

If you’d like to learn more, check out Thrifty and sign up for a free 7-day trial.

How We Manage our Money

We’ve been using Capital One 360 for our checking and savings accounts for years. We’ve been really happy with their ease-of-use and interest rates. In addition, we just got approved for a Capital One Venture card and have been using that to earn travel rewards to help fund our family’s adventures :)

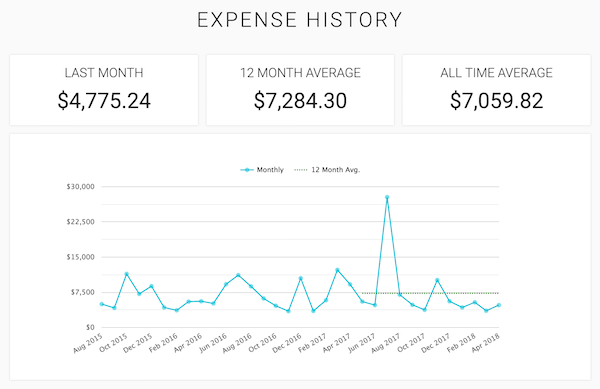

Spending Summary - $4,775.24

In April, we spent a total of $4,775.24. Our mini-retirement budget for the year is $60,000, so I’m proud of us for once again keeping below our monthly average target of $5,000.

Here’s how we’ve been trending on our spending:

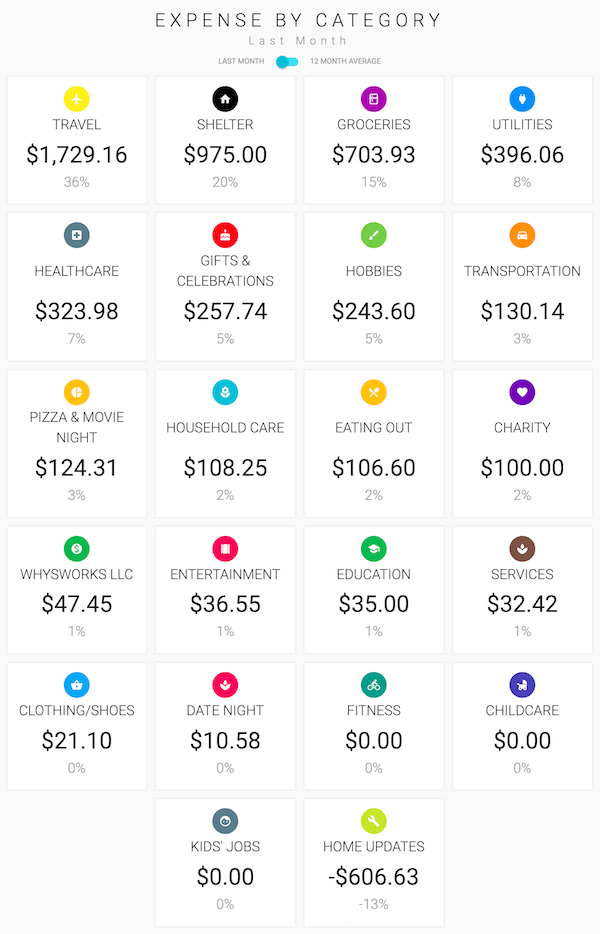

Next, let’s take a look how we spent by category this month:

And here’s a breakdown of each category:

| Category | Amount | Notes |

|---|---|---|

| Charity | $100.00 | We continued our regular contributions to our church and The Hope Effect, one of our favorite charities. |

| Clothing/Shoes | $21.10 | Amazingly, we didn’t spend anything on clothing or shoes in the first three months of the year this year. The reason we broke it in April? I got a hole in the knee of my jeans and needed to get a new pair. I tried Goodwill but didn’t have any luck finding something in my size so I resorted to the clearance section at Old Navy. |

| Date Night | $10.58 | I took Jaime out for coffee at the local cafe. Another night, I grabbed a movie and some chocolate for Jaime and me to watch after the kids went to bed. Date night doesn’t have to be a big expensive affair! |

| Eating Out | $106.60 | Much better this month! We had three unplanned meals out, six trips for treats, and some refreshments when we took the girls roller-skating. |

| Education | $35.00 | We continued my subscription to Treehouse - an online coding school to help me keep my skills sharp. In addition, we donated to a “teacher appreciation” gift for our kids’ teachers. |

| Entertainment | $36.55 | After having a few birthday parties at the local roller skating rink, our kids are hooked. So, we went as a whole family this month and it was a blast :) |

| Gifts & Celebrations | $257.74 | Our twins turned 6 this month! We bought them each a dress and a swimming cover-up and took them out to dinner. Their parties are in May, so we’ll see the rest of the cost there. |

| Groceries | $703.93 | I’m still amazed at how well we’re holding our grocery bill down. Every week we sit down to hammer out a grocery list and we really seem to have found our groove on cost! |

| Healthcare | $323.98 | One dental visit and some vaccinations for Jaime and I for our upcoming anniversary trip to Costa Rica |

| Hobbies | $243.60 | Swimming lessons for the girls |

| Home Updates | -$606.63 | Remember our great floor sleeping experiment? Remember how we had bought a bed? We finally decided to return it, so we got a pretty big refund this month! |

| Household Care | $108.25 | Light bulbs, laundry detergent, conditioner, dishwasher detergent, toothpaste, band-aids, toilet paper, face wash, water softener salt, and a furnace filter. |

| Pizza & Movie Night | $124.31 | Our Friday night family tradition continues. |

| Services | $23.74 | Life insurance from Haven Life for Chris, printing a few pages at the library, and a haircut for Chris |

| Shelter | $975.00 | Rent for our 1150 square-foot apartment |

| Transportation | $130.14 | We used three tanks of gas this month. |

| Travel | $1,729.16 | Jaime and I booked our flights to Costa Rica for our 10-year anniversary in July! |

| Utilities | $396.06 | Water/sewer (a quarterly bill that hit this month), internet and gas/electric |

| Business Expenses | $47.45 | Business expenses - app hosting fees for Thrifty and MNY and our email management tool (we use ConvertKit). |

| Total | $4,755.24 |

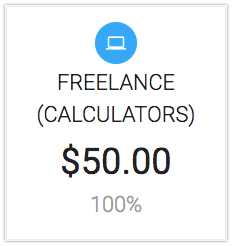

Side-Hustle Income Summary - $50.00

So, this is a new section for these posts because there’s actually something to report here!

Earlier this month, Jaime and I launched our Work With Us page to give us an avenue for some side-income. Sure enough, I got two takers for designing embedded calculators and was able to complete (and get paid for) one small project to the tune of $50.

While the amount isn’t game-changing, the precedent is. I’ve got something I can do at least a bit of on the side to make income during this mini-retirement. In addition, it’s something that I can hustle at on the side if/when I have to return to a 9-5 as a way to get a few extra dollars here and there.

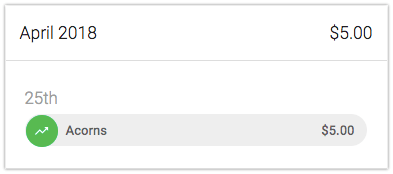

Savings Summary - $5.00

One new section isn’t good enough, so here’s another!

Jaime’s been wanting to understand investing better so she decided to take the leap and open an account with Acorns. She put her first $5 in and linked up to our bank account so we can start depositing more.

$5.00 may not seem like much, but we’ve been on a saving hiatus during the mini-retirement, so this is us getting a foot back in the proverbial door.

We like what we’re seeing with Acorns so far - it’s definitely a non-intimidating way to get started with investing. We’ll give you more info as we get deeper in.

If you sign up for Acorns here, they will invest $5.00 for you! Almost as good? They’ll give us $5.00 too :)

How Was Your April?

It’s been nice having something to report on the income and savings side. Hopefully, we’ll continue to have new numbers to report for each of these in future months!

Don’t forget to check out Thrifty, the app behind all the pretty screenshots in these reports. You can get your own tracking started for free with a 7-day trial!