As we pulled up to the parking attendant’s booth and I took out my credit card, my daughter called out from the back seat with a tone of frustration:

“Great, now we have to waste our money to park here?”

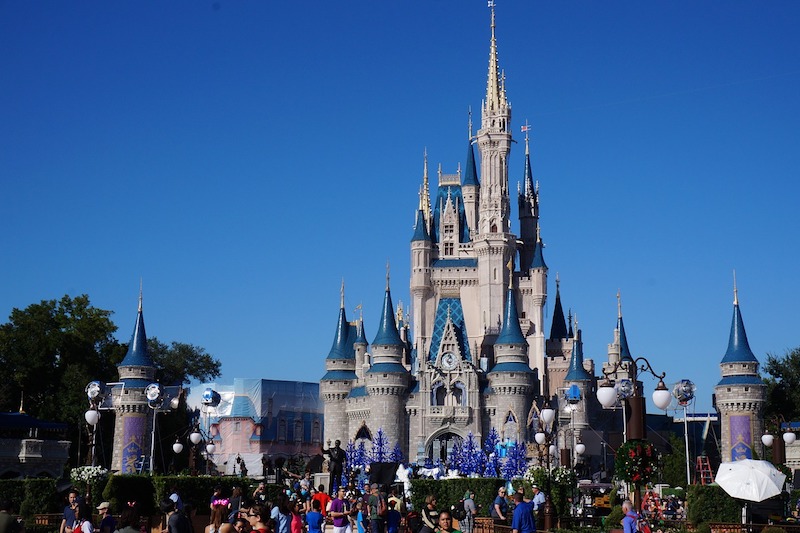

I asked her to hold on to that thought as I finished paying the $22.00 for our parking space at Disney World’s Magic Kingdom. I was a bit surprised by her comment, but as a parent, I could recognize a teaching moment when I saw one.

As we wound our way through the parking lot, I asked my daughter whether she was excited to be going to Disney World. As you’d expect from just about any 6-year-old, the answer was an enthusiastic yes.

I asked if this road trip was something important and valuable to our family. She nodded.

I asked if this was more important to us than some of the other things we’ve chosen not to spend money on. She smiled and I knew the message had gotten across.

Our $2,400 “Waste” of Money

We spent 10 days this month road tripping from Wisconsin down to Florida and back. We stopped at parks, playgrounds, and restaurants. We stayed with family, went to the beach, and swam in the pool. On our way home, we spent a day at Disney World, meeting princesses, riding flying elephants, and spinning in teacups.

All told, the trip cost us $2,400. That may seem like a big chunk of change, but for the memories we made and the time we got to spend together as a family, it was worth every penny.

We didn’t finance this with a loan, or credit card debt - we had the money set aside for the whole trip before we booked our first night.

This trip (and all of our trips) was the result of intentional savings so we could intentionally spend on what’s important to us (Tweet this )

How We Could Have Actually Wasted $2,400

Saving up $2,400 for a trip may seem daunting. But breaking things down into pieces, it’s $200 a month.

Even that may seem daunting, but here are the things we’ve chosen to forego that make a $2,400 annual trip possible:

- Cable TV ($60/month)

- Netflix ($8/month)

- Amazon Prime ($13/month)

- Eating out for lunch on work days ($5/day * 20 days/month = $100/month)

- Drinking coffee instead of soda ($32.50/month)

Boom - that’s $213.50 a month, or $2,562 a year in savings that can fund a trip.

And when I compare the joy, memories, and fulfillment that I’d get out of a 10-day family road trip to what I’d get out of watching more TV and eating/drinking things that are less healthy, the winner is clear.

Spending money on what’s important to you isn’t a waste - it’s precisely what you’re supposed to do.

Yes, you have to cover the necessities first, but after you clear that bar, the best way to utilize your money is to identify your priorities and put your money where your heart is.

How to Know if You’re Wasting Money

A few years ago, we didn’t really know where our money was going. We weren’t accruing new debt, but we also got to the end of every month wondering why our paychecks had disappeared.

We knew we had to start tracking our spending to see what was eating up our money. So, I developed Thrifty and we’ve been tracking every penny since.

We discovered that we’d been spending $3,300 more each year on food. We saw the money we were sinking into home updates.

As we dug into our spending habits, we started seeing waste everywhere and knew we could do better.

We had dreams we wanted to accomplish but felt financially limited. What we hadn’t realized was that we were our own biggest barrier.

Over the last three years, we’ve worked hard to eliminate the waste so we can redirect our money to our true values. Family adventures, investing in our relationships and being healthier in what we consume (both food and entertainment).

If you have a dream you want to accomplish but feel like you can’t get there, it’s worth looking first at your situation and seeing what you can control. You may not be able to negotiate a 50% pay raise tomorrow, but maybe you can find one bad habit to eliminate that frees up a bit of your budget.

So, start tracking, keep dreaming, and don’t be afraid to eliminate some waste.

Join Me for #TomorrowTalk

Related to this topic, I’ll be the guest for #TomorrowTalk this week - a twitter chat where we talk about tips and tricks for saving for your family vacation. Get on Twitter at 8PM EST on Thursday, June 22nd to join the conversation!