This article contains one or more affiliate links. We only link to things we support and think you could find useful. If you pay for something you clicked on in this article, we may get a commission as a result.

Last year, we published regular spending reports as a part of our Nothing New Year. While the Nothing New Year is over, we’ll still be publishing monthly spending reports with a few tweaks. Let’s get started!

Money can be a taboo topic, but we think that’s silly. We’ve found a ton of value in seeing how other families are managing their money and we want to provide the same back to the community. With that, here’s a deep dive into our January 2018 spending.

Personal Update

January was an action-packed month for our family. We:

- celebrated Jaime’s birthday

- spent two weeks in Hawaii - getting one state closer to our goal of visiting all 50 with our kids

- dealt with lots of illness (influenza and stomach flu) - and all the headaches that come with new health insurance

- reflected on the first half of our mini-retirement and set goals for 2018

- made the most of Wisconsin winter while missing the Hawaiian sun :)

Overall, we did a pretty good job managing our spending - especially since we spent almost half of the month in one of the most expensive areas of the United States!

Spending Summary

We track our spending using a little tool I made called Thrifty. We’ve been using it for over 2 years and it’s really helped us get a handle on our finances.

The screenshots you see below are straight out of our account in Thrifty. If you like what you see, consider giving it a try yourself. Head over and try it for free

In January, we spent a total of $4,276.91. Our mini-retirement budget for the year is $60,000, so any month under $5,000 is a good month in our book!

Here’s how we’ve been trending on our spending:

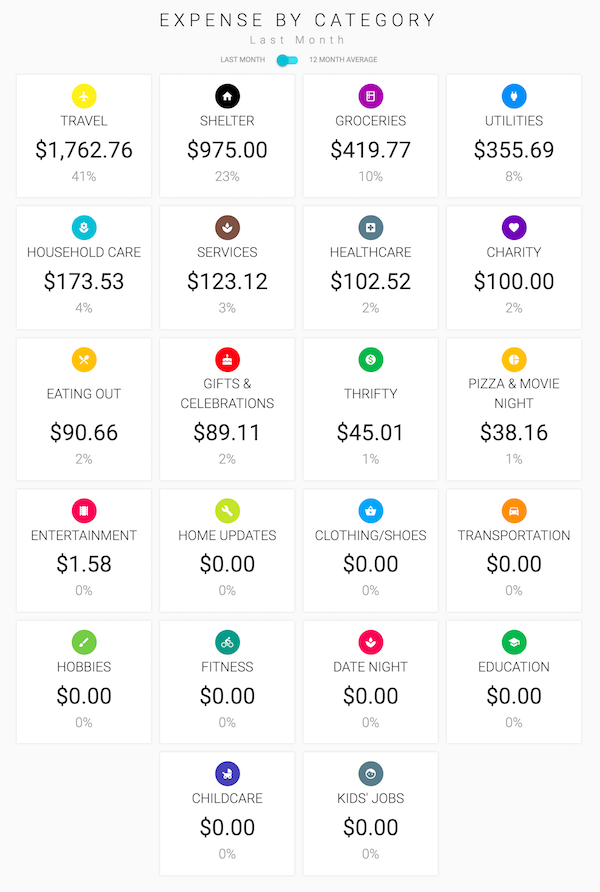

Next, let’s take a look how we spent by category this month:

And here’s a breakdown of each category:

| Category | Amount | Notes |

|---|---|---|

| Charity | $100.00 | We continued our regular contributions to our church and The Hope Effect, one of our favorite charities. |

| Eating Out | $90.66 | Influenza really messed with everyone’s appetites, so we had a bit more eating out than we’d normally like as we recovered from that. |

| Entertainment | $1.58 | Aside from one Redbox rental, we got all of our movies and books from the library this month for free! |

| Gifts & Celebrations | $89.11 | The kids redeemed one of their Christmas presents - a trip to the movie theater to see Disney’s Coco. Jaime and I also went to Olive Garden for lunch on Jaime’s birthday. |

| Groceries | $419.77 | This is definitely lower than normal - because it doesn’t include the food we bought when we were in Hawaii. For the 2.5 weeks we were home, we averaged about $200 a week - right on target with our goal. |

| Healthcare | $102.52 | I had the pleasure of getting influenza while in Hawaii. Thanks to the wonders of Tamiflu though, I was only laid up for 2 days :) |

| Household Care | $173.53 | Shampoo, toilet paper, feminine products, band-aids, toothpaste, a travel razor, tissues, replacement toothbrushes, and Ziploc bags. |

| Pizza & Movie Night | $38.16 | Our Friday night family tradition continued for the weeks we were home this month. This cost includes two pizza nights. |

| Services | $123.12 | Life insurance for both Chris and Jaime, a haircut for Chris, and fees for freezing both of our credit reports. |

| Shelter | $975.00 | Rent for our 1150 square-foot apartment |

| Thrifty | $45.01 | Business expenses - app hosting fees for Thrifty, and our email management tool (we use ConvertKit) |

| Transportation | $128.20 | With a bit of travel around the holidays, we needed extra gas this month, consuming three full tanks. |

| Travel | $1,762.76 | We spent two weeks in Hawaii! You can see our full cost breakdown below. |

| Utilities | $355.69 | Internet, gas/electric, and water/sewer. |

| Total | $4,276.91 | Total without Travel: $2,514.15 |

With our biggest expense area this month being our trip to Hawaii, I thought it might be nice to dive in a bit deeper and look at the details of our travel spending.

Spending Deep Dive: Travel

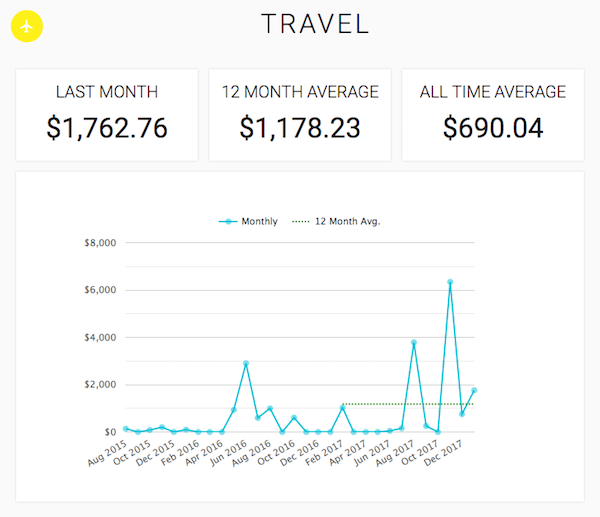

Here’s how our travel spending has trended over time:

You can tell that traveling is a priority and we’re trying to make it even more so. During our mini-retirement, we’re scheduled to take 4 trips:

- a road trip of the northeastern USA (done!)

- a 2-week trip to Hawaii (done!)

- a trip to the Caribbean for our upcoming 10-year anniversary (summer 2018)

- a “Wisconsin Staycation” - visiting the best our state has to offer (summer 2018).

It all adds up, but it’s what we love to do. This is one of the big reasons we track and manage our spending - so we can reduce our spending on other stuff and make space for traveling!

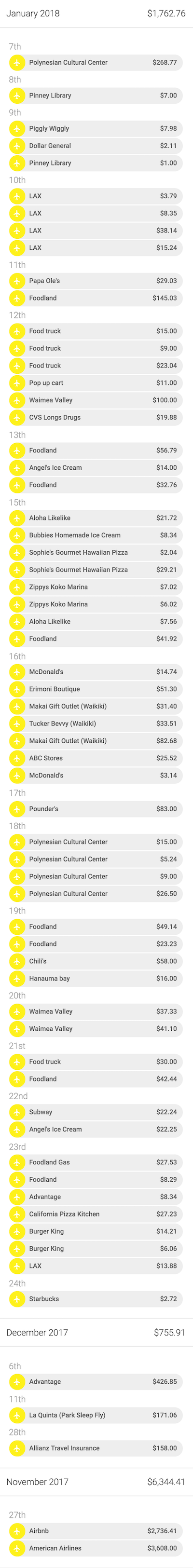

Hawaii Spending Details

While in Hawaii, we spent $1,762.76 but our overall trip cost quite a bit more. We booked our flights, Airbnb, rental car, and travel insurance back in November and December.

When we add those in, the total cost for our family of five for two weeks was $8,863.08. Subtracting out our normal cost of food for this time period ($500 between groceries, eating out, and pizza/movie night), we averaged a cost of about $1670 per person for our trip.

Before you ask, no we haven’t been travel hacking so we paid for this all out of pocket. We’ll get there someday :)

| Subcategory | Amount | Notes |

|---|---|---|

| Airfare | $3,608.00 | Flights from O’hare to Honolulu with a layover in LAX each way. We chose to stay in O’hare because the flights were a bit cheaper (even with the added cost of staying in a hotel the night before our flight out) and we were able to pre-book seats for all legs of the flight. |

| Lodging | $2,907.47 | We stayed at an awesome Airbnb in Laie on the island of Oahu. In addition, we had a one-night stay at a hotel the night before our first flight that allowed us to leave our car there and avoid parking charges at the airport. |

| Eating Out | $638.36 | We’ve been working hard on reducing our eating out expenses at home but on vacation, we give ourselves a little grace and eat out way more often. Fortunately, staying in an Airbnb with a kitchen helped keep this from going even higher as we cooked for about half of our meals. |

| On-island Transportation | $484.44 | We got a relatively inexpensive (but nice) rental car from Advantage. Because we went with a high MPG vehicle, we only spent $58 on gas, despite doing a lot of driving around the island. We saved on transportation by declining rental car insurance (our credit card and home car insurance paired perfectly to cover collision and liability respectively) and bringing our own super-portable car seats for the kids. |

| Grocery and Household | $409.69 | We cooked about half of our meals (all breakfasts and most lunches). Groceries are expensive in Hawaii but if you know what to look for (fresh local fruit = yes; imported baked goods and meat = no) you can make it work. In addition, we had some household purchases like sunscreen :) |

| Activities | $384.77 | Most of our activities were free, but the three big activities we paid for were the Polynesian Cultural Center, Waimea Valley, and Hanauma Bay. |

| Souvenirs/Clothing | $259.11 | The majority of our souvenirs were clothing but in most cases, it was clothing we needed. Jaime’s old sandals had broken and my swimsuit decided to stop having any elasticity after 10 years. Replacements for both were well warranted. We did buy a Hawaiian dress for each of our girls; they’re still wearing them weekly despite our Wisconsin winter weather :) |

| Insurance | $158.00 | We did opt in for travel insurance. As it turns out, we almost needed it as Jaime and the girls got the flu just a week before we were due to leave. Fortunately, they got better before we left. I decided to wait until we were in Hawaii to get sick. |

| Other | 13.24 | Printing directions and our boarding passes at the library and buying a thank you card for our Airbnb host |

| Total | $8,863.08 |

In Thrifty, we can look at every individual expense - and there were lots. We paid for something 58 times while we were there! If you care to see the details - check below for every penny and every vendor.

Digging in, here’s one fun expense - our admission and parking for the Hanauma Bay Nature Preserve:

We spent $16.00 there to cover parking ($1.00) and admission ($7.50 each for Jaime and me). We got to hang on the beach, build sand castles, and do some snorkeling along the reef. It was one of our favorite stops on Oahu - I definitely recommend it!

Our trip was amazing - we had so much quality family time and found a lot of peace and joy in. Knowing how much money we spent in each area will help us plan for future trips going back. In our dream world, we’d be headed there every winter for a break from the Wisconsin cold :)

For more details on what we did while in Hawaii (and what we recommend for others), you can check out my post on the Rockstar Finance Forums.

Hope you enjoyed the deep dive into our January finances. Let us know what you think of the new format and if you’ve got any questions about our spending this month or the trip! Aloha!