Our mini-retirement was an incredible year of travel, family time, and personal growth. Beyond the amazing experiences we had, we learned so much about ourselves, our dreams, and where we hope to direct our lives in the future.

But taking a year off of work doesn’t come without a cost. Was it worth it?

Let’s take a look at the numbers and you can be the judge.

Planned Mini-Retirement Budget

Before we started our mini-retirement, we analyzed our spending in Thrifty to get an idea of what we’d be spending. We used the data from two years of spending, along with our projections about how our spending in Mini-Retirement would be different to come up with a detailed budget for the full year.

Our mini-retirement budget totaled up to just over $60k ($60,206.88 to be exact).

Changes In Course

A proper budget reinforces your priorities through a financial plan (Tweet this )

Our original budget captured our intentions and priorities for the year. As the year progressed, we had two opportunities arise that fit our goals and were worth deviating from the budget.

Had we known of these ahead of time, we would have built them in :)

First, we bought land in our town. A low-cost piece of land (roughly 40% the cost of most other lots) was listed in our area with the benefit of no deed restrictions. That meant we could build a small, cozy home of our dreams in the community we love. We jumped on the opportunity and happily got the land at the listing price.

Second, we decided to travel to Hawaii. This was one of 4 states we hadn’t visited yet as a family and we were looking for a way to break out of winter in the midwest. We loved the aloha spirit we found there and the trip gave us clarity on the life of travel we wanted to create.

Actual Mini-Retirement Spending

Because our land purchase is a non-depreciating purchase and helps us toward payment freedom, we don’t include it in our actual spending. We think the same way about principal payments on a mortgage.

Here’s the detailed comparison of what we planned to spend with what we actually did, excluding our land and Hawaii trip spending.

| Category | Planned | Actual | +/- |

|---|---|---|---|

| Shelter | $11,700.00 | $16,496.88 | $4,976.88 |

| Groceries | $10,433.33 | $8,496.02 | -$1,937.31 |

| Travel | $5,520.00 | $7,215.84 | $1,695.84 |

| Healthcare | $5,613.92 | $4,861.68 | -$752.24 |

| Transportation | $3,700.00 | $2,330.76 | -$1,369.24 |

| Household Care | $3,000.00 | $2,869.56 | -$130.44 |

| Utilities | $2,533.52 | $2,476.80 | -$56.72 |

| Hobbies | $2,500.00 | $2,869.56 | $369.56 |

| Gifts & Celebrations | $2,200.00 | $1,685.04 | -$514.96 |

| Pizza & Movie Night | $1,825.83 | $1,065.60 | -$760.23 |

| Date Night | $1,825.83 | $381.84 | -$1,443.99 |

| Clothing & Shoes | $1,800.00 | $2,366.28 | $566.28 |

| WhysWorks LLC | $1,600.00 | $855.00 | -$745.00 |

| Charity | $1,500.00 | $1,202.04 | -$297.96 |

| Education | $800.00 | $762.96 | -$37.04 |

| Services | $734.44 | $1,784.28 | $1,049.84 |

| Entertainment | $500.00 | $365.64 | -$134.36 |

| Eating Out | $420.00 | $1,370.52 | $950.52 |

| Fitness | $0.00 | $1,058.28 | $1,058.28 |

| Home Updates | $0.00 | $662.76 | $662.76 |

| Childcare | $0.00 | $114.96 | $114.96 |

| Kids Jobs | $0.00 | $13.20 | $13.20 |

| Unassigned | $2,000.00 | $0.00 | $0.00 |

| Total | $60,206.88 | $61,103.40 | $896.52 |

Excluding our Hawaii trip and land purchase, we were about $900 over budget. Adding in our Hawaii spending and our total spend for the year was $69,966.48.

A couple notable lessons from our spending and budget:

- We forgot to include the pro-rated property tax from the sale of our home in our original budget - that was about $3,000 of expense.

- We didn’t realize how much less we’d spend on transportation. Without a daily commute (even though it was only 8 miles), we saved a bunch on gas. This also led to savings on maintenance as well!

- We put $2,000 in an unassigned category in our budget - this gave us flexibility for unexpected purchases, like buying Jaime and our oldest daughter bicycles, etc.

Total Mini-Retirement Cost (Cash and Net Worth Impact)

So, the total cost for one year of mini-retirement for our family was $69,966.48.

Or was it?

One way to look at the cost of the mini-retirement is to look at the total spending for our year. But another way would be to look at the impact on our net worth.

After all, during this year, we did earn some freelance income, received a payout from my old employer, and our investments continued to grow.

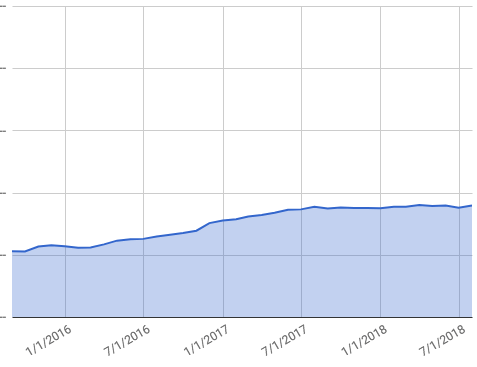

Our net worth actually increased by 1.55% during our mini-retirement! (Tweet this )

So, in one way of looking at it, we actually made money during our mini-retirement.

That’s the power of investing, friends. All those years of savings are paying off with financial momentum!

Our net worth certainly would have been much higher if I had continued working and making contributions to our investments, but it’s amazing to think that we made it through the year with our net worth increasing!

Was It Worth It?

Through the mini-retirement, I got a chance to try my hand at entrepreneurship, which had been a lifelong dream. I discovered what parts worked (and which parts didn’t) for me and ultimately decided that heading back into the workforce was the right fit.

As a family, I got to take my kids to school and home almost every day, volunteer more in the classroom, and do a bunch of travel (a road trip to the northeastern US, two weeks in Hawaii, a trip to Florida, and our 10-year anniversary trip to Costa Rica).

Now, I’ve landed a remote software developer job that I’m super excited about. This job should give us work-life balance and flexibility to travel, all while letting me pursue a career path that I’ve been excited about for a long time.

As one of my good friends coached me (during one of my more stressful moments in the job search), “If you spent the last year and figured out what you really want in life, you’ve gained something that most people will never achieve. That’s worth every penny.”

We plan to stay in our community in Wisconsin, build our tiny white shack and focus on building a life focused on faith, positive family routines, and lots of adventure.

So yes, this year was absolutely worth it. We’ve got an exciting vision for the future and are so excited for the next chapter in our life!