Patience is a virtue, but it’s more than that. It’s an incredible source of passive income. OK, maybe not income in the traditional sense, but at the end of the day, patience leaves you with extra money in your bank account for doing absolutely nothing.

Every generation needs an anthem but I’m afraid if our shopping behavior is any indication, our anthem isn’t a flattering one.

I want it all, I want it all, I want it all, and I want it now

Queen

We’re so focused on getting what we want right away that we misunderstand how much our impatience is costing us and what we could earn by exercising our patience instead.

Let’s look at an example:

How Patience can Save You Big Bucks on Technology

What happens every time Apple releases a new phone? There’s always a segment of the population that chooses to wait in a line overnight for the privilege of buying that phone at the highest price it’ll ever be sold at.

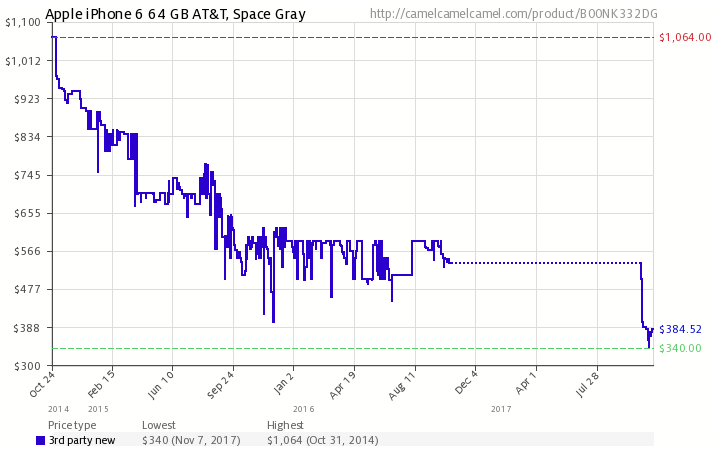

In October of 2014, you could get an Apple iPhone 6 (64 GB with AT&T) for the embarrassing price of $1064. Within two months, that price had dropped below $900. In another three months, it was down below $700. One year after launch, the price settled at around $572 - almost half of what it started at.

Here’s a full chart of the pricing over time courtesy of CamelCamelCamel.com

Unless you’re solving nuclear physics problems on your phone, you can probably get by with a 1-year-old phone.

The reward for your patience - for doing absolutely nothing? Almost $500. And that’s not even counting the extra you could make from putting that money in a high-yield savings or investment account.

Getting $500 for just not buying something for a year is awesome, but in all honesty, I haven’t given you the full story. The discount for many people is even bigger.

The Compounding Pain of Impatience

The impatient don’t just tend to buy things at their highest price, they also tend to buy them on credit. As a result, they finance unnecessary items and pay an arm and a leg in interest.

Suppose an impatient buyer put that $1064 phone purchase on a 17% APR credit card and planned to pay it off over two years (at payments of $52/month). By the end of the two years, they would have paid $1432 for the phone.

On the flip side, a patient buyer would just stash away $52/month until they had enough to pay for the phone in cash. After one year, they could buy that phone for $572.

Compared to the impatient buyer, the patient one actually has an extra $860 in their bank account at the end of those two years!

Whether you look at it as passive income or as a heavy 60% discount, the patient buyer is clearly killing it here.

But patient buyers can take things even a step further and get stuff for free!

How Patience can get you 100% Discounts on Entertainment

Who doesn’t love a Friday night movie?

I love the experience, but can’t stand the price. As it stands now, taking our family of five to the theaters (even if we forego the 3D screen and IMAX) can set us back $50 in one evening - just for the tickets!

But an average movie only spends 4 weeks in the theater and comes out in digital and on DVD after about 16 weeks.

By waiting 16 weeks, we can drop that $50 to $5 for a rental - a discount of 90%.

But why pay when you can get something for free?

At our library, new releases are usually in high demand, so you may wait an extra 1-6 months, but the price can’t be beat.

Another thing libraries have? Books! (I know - crazy, right?)

Getting a book in hardcover (typically the first format released) can easily set you back $20. Libraries often get popular books within 1-2 weeks of their release though.

Depending on your wait, it may take anywhere from 0 to 6 months to get that 100% discount. But it’s still a 100% discount!

The Easiest Passive Income You’ll Ever Make

Businesses love to get your hard-earned dollars and they know that one of the easiest ways for them to do this is to play on your impatience.

Is waiting 6 months for Game of Thrones to be available at your library going to make your life unbearable? Or are we just used to having things so conveniently and quickly available that we tell ourselves we couldn’t possibly wait?

You’re stronger than that. When you exercise patience, you’re not depriving yourself - you’re making a trade-off (and a very smart financial one at that).

After all, a really smart old guy once said:

A penny saved is a penny earned

Benjamin Franklin

The concept of getting paid for doing absolutely nothing sounds like a dream to me (Tweet this ) .

So put the pause button on those purchases and watch your bank account grow. You’ll quickly find that those urgent purchases weren’t so urgent after all and your dreams are a lot easier to reach.

Are there things you struggle to be patient for? Where have you seen patience make a big impact on your finances?