We are so excited to introduce you to Mr. & Mrs. XYZ from Our Financial Path. Saving for a home down payment can seem impossible when you feel like you are living paycheck-to-paycheck, but this couple is here to tell us its not only possible, but life changing. Here’s their story on how they managed to save up enough for their down payment in a single year.

Backstory

What was your life like before you pursued your dream?

Three years ago, we lived in a big Canadian city, renting a small condo in the downtown core. We are young professionals who worked hard, played hard, and biked to work every day. This was a great way to stay active and live car-free!

What was your freedom dream and what was the inspiration/catalyst behind it?

After living in the city for a few years, we felt like we just needed some air. We started talking about moving out of the city and buying a home.

When we talked about the lifestyle we wanted, being close to nature, and our budget, we found ourselves looking for a home in the suburbs. We dreamed of a nice large home with a yard, close to mountains and lakes, with enough space for all our projects. I wanted a garage to do woodwork and small projects and Mrs Xyz wanted an office to work from home sometimes.

Strategy

It’s one thing to have a dream. It’s another to make it a reality. How did you plan to turn your dream into a reality?

We needed to save up enough money for a down payment. Based on our budget and the type of home we were looking at, we were looking at purchase prices anywhere from $300,000 to $400,000. Building up a good down payment was no easy feat but with the right mindset, we were able to assess our goal and succeed.

The first thing we did was track our finances. Our big three expenses were Housing, Transportation, and Food. Knowing this, we were able to focus on making small sacrifices in in order to stay on track with our savings goal. We drove our ten-year-old cars (we drive a Honda Fit, pictured above) and rarely went out to restaurants. Buying a reasonably-priced home in the suburbs would keep our costs low as well.

By adjusting our spending, we were able to save over $1,000 more each month for our down payment.

What challenges did you face along the way and how did you push through?

While saving for our down payment, we were also investing in the stock market. We were focusing on day trading without knowing much about the stocks we were buying. After a few months, we had one bad day where we lost $2000 in a single day. That didn’t help us at all in working towards our freedom dream.

After that experience, we stopped trading without research and stopped day trading altogether. We now invest in index funds with Vanguard.

How did your dream evolve or change as you worked towards your goal?

In saving for our down payment, our lifestyle changed a lot. We were no longer living paycheck-to-paycheck. It was a great feeling. When we looked at our numbers, we saw that we were on track to save for our down payment in a single year! We couldn’t believe it! And to make it better, we realized that we could stick with our lifestyle change and our future would be full of endless possibilities.

Life Now

What is your life like now? What have you learned since reaching this dream?

We are loving the suburban life right now. We have access to nature, live right beside a huge park, and 10 minutes away from a ski hill. We now go regularly on hikes on this mountain only 10 minutes away from our place, it is so refreshing and energizing to walk alongside the stream. One of our favorite spot is on the very top of the hike, you can see the city skyline, then the suburbs, then farmland for miles away.

Getting into town takes less than 40 minutes and we spend much less for much more compared to the city.

Do you have any regrets or things you would do differently?

We did buy a pretty big house. We have 5 bedrooms, 3 baths. Looking back, we could have lived with less.

What would you say to someone who wants to do what you did?

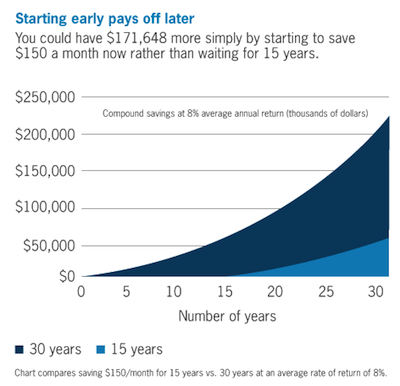

There is no secret, start saving, invest in what you know, and enjoy. The earlier you start saving, the greater you will benefit from the magic of compound interest. For example, If you want to save up for a down payment, know what you are saving for, fix yourself a monthly target, track your finances, and stick to your plan until you reach your goal.

The easiest way to start is with automatic systems. Deduct some money right off your paycheck and invest it or setup an automatic transfer from your checking account to your investment account to invest on auto-pilot. As long as you start today, you are better off than anyone starting later on.

Another Dream Begins

We never stop dreaming and growing. What’s your next freedom dream?

We first found out about financial independence with the random button on Reddit. From there, we both read MMM, jlcollinsnh.

Seeing how others were working on projects they loved, enjoying the simple things in life, and retiring in their 30s and 40s was an eye-opener for us. The FI community is really inspiring and we have made it our goal to reach financial freedom and retire before age 35.

How are you planning on achieving this new dream?

The biggest increase in wealth, when you are starting out, is your savings rate. We are currently aiming for a 50% savings rate (currently more around 60%) to rapidly build our wealth and retire at 35 years old.

We follow a fairly simple 3 fund portfolio as our base holdings to keep our costs low and risk in line with our goal. We invest through Vanguard, mainly into the US Total Market (VTI), All Cap Canadian Index (VCN), and International Indexes (VWO)(VEA). You can see our exact holdings and asset allocation in our Open Book series.

Thank you to Mr. and Mrs. XYZ for sharing their story. We love that they started tracking their finances and made trade-offs in their spending to accomplish their dream. We wish them the best and great success in reaching FI by age 35! We can’t wait to see what life has in store for them in early retirement!

Do you have a freedom story you would like to share? We would love to hear from you! Submit your story here!