One of the biggest challenges when working toward financial independence is patience. Once you’re tracking your spending, minimizing waste, and investing responsibly, there’s a lot of waiting. Compounding growth is amazing, but it takes time!

As a refresher, financial independence is when you no longer have to bring in active income to maintain your lifestyle. A rough rule of thumb is that you’ll need to save 25 times your anticipated annual expenses.

Financial independence is the granddaddy of all financial goals. Once you’re there, money shouldn’t have a hold on you anymore.

But the road to financial independence usually lasts for many years. And there aren’t many opportunities to celebrate along the way.

With that in mind, we came up with our own intermediate milestone. We call it Retirement Freedom.

Here’s our definition:

Your retirement accounts are big enough for you to retire at 65 even if you stopped contributing today (Tweet this )

If you never put another penny in your retirement accounts but they’d still grow to allow you to retire at age 65, congratulations - you’re retirement free!

The Retirement Rocket

I love analogies, so here’s one that captures Retirement Freedom well.

Imagine a rocket taking a capsule into outer space. There’s a ton of force needed to get off the ground, not to mention escaping earth’s atmosphere. Once the payload is in space, the rocket has served its purpose. It separates from the capsule and burns up in the earth’s atmosphere.

If financial independence is getting to the moon, Retirement Freedom is the point where the rocket separates from the payload.

You’ve done your hard work saving and have taken care of the toughest part. Armed with the security of a future retirement, you can direct your attention to the fun of navigating the financial cosmos._

What Retirement Freedom Buys You

When you know that you’ve secured age 65 retirement, you can focus on making the most of the time between now and then (Tweet this )

If your income no longer has to cover saving for retirement, all you’re responsible for is your annual expenses and building a bit of a safety fund.

With that, you can have the flexibility to live better now. You could:

- Reduce your hours at work or take a lower-stress job

- Take more time to travel while you’re young

- hustle hard and bring that retirement date in from age 65 to age 40.

For me, reaching Retirement Freedom provided the financial confidence to leave my 9 to 5 job and take a one-year mini-retirement.

Reaching Retirement Freedom takes some of the pressure off the path to financial independence. With your newfound flexibility, you might be able to live pieces of your dream life even earlier.

Have I sold you on the concept yet? Good.

So how can you know whether you’re there or not?

Retirement Freedom Math

If you’re not interested in the math, feel free to jump ahead. Otherwise, let’s dive in.

Let’s call Rt your retirement funds today and g the rate you expect your retirement funds to grow with no contributions. If we call R65 your projected retirement funds at age 65, then:

R65 = Rt * (1+g)^(65-age)

Let’s call Et your expected retirement annual expenses (in today’s dollars). We’ll call t your expected tax rate on your retirement funds and i your expected rate of inflation. Finally, let’s call r your chosen safe withdrawal rate.

If we call E65 your target retirement funds at age 65, then:

E65 = Et * (1+i)^(65-age) / (1-t) / r

If your assumptions hold true, and you find that R65 is greater than E65, then I’d like to say congrats - you’re Retirement Free for age 65!

Pretty awesome, right?

Retirement Freedom Calculator

You didn’t think I was going to make you do these calculations by hand, did you?

Retirement Freedom Calculator

Enter your numbers to see if you've reached Retirement Freedom

It’s Spreadsheet Time

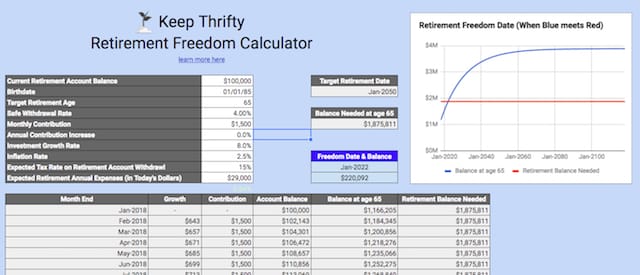

In addition, if you’re like me and love a good spreadsheet, I’ve got a Retirement Freedom spreadsheet that covers everything above and can tell you when you’ll reach Retirement Freedom if you’re not already there.

I’m pleased to present you with the Keep Thrifty Retirement Freedom Calculator in spreadsheet format:

- Google Sheets: Keep Thrifty Retirement Freedom Calculator

- Downloadable MS Excel File: Keep Thrifty Retirement Freedom Calculator

Get the sheet in whatever format you prefer and enter your information. You can see where you stand for Retirement Freedom by looking in cell F13.

You’ll see one of the following:

- Already There! - Congrats rockstar - you’ve done a great job so far and you should go celebrate!

- A date - This is when you’re projected to hit Retirement Freedom based on your current contributions. You’ve got two options to improve your date: increasing contributions and/or reducing your expected expenses.

- Never :( - Based on what you’ve entered, you’re not on track to be able to retire at the age you put in. Adjust your “Target Retirement Age” to see when you actually can retire. Then look at your contributions and your expected retirement expenses to see how you can improve.

Go ahead and play around. Using the fields can lead you to some pretty interesting scenarios.

Retirement Freedom Scenarios

Here are some of our favorite scenarios using the spreadsheet:

- Without my projected pension payout, we could stop contributing to our retirement accounts and still retire at age 70.

- If we include my projected pension payout, we’ve already hit Retirement Freedom! Time for the happy dance :)

- A baby born today could be Retirement Free by their 18th birthday. At $20,000 annual retirement expenses, their parents would only need to make a monthly contribution of $169 from birth to age 18. Wouldn’t that be a nice graduation present? This feels a bit like Mr. Groovy’s Junior IRA concept.

If you haven’t reached financial independence, consider Retirement Freedom as a stepping stone. It’s a great way to celebrate progress on your path and gives you new options between now and retirement.

When saving stops being a necessity, your world fills with options (Tweet this )

What could achieving Retirement Freedom do for you?

How do your numbers shake out? When will you reach Retirement Freedom? How would you live once you got there?