If you’ve got a mountain of debt, there are two awesome ways to shred it - the Debt Snowball and the Debt Avalanche. Read on to learn how to choose which is right for you and what to do if you can only pay your minimums. If you’re already well-versed, check out the end of the post for an awesome spreadsheet to show how much better Debt Avalanche is.

Debt Snowball vs Debt Avalanche

It’s easiest to describe these concepts with an example.

Let’s say our good buddy Jim has racked up a bit of debt and is looking to get debt free:

| Debt | Current Principal | Rate (APR) | Minimum Payment |

|---|---|---|---|

| Auto Loan | $5,500 | 4.00% | $200 |

| Credit Card | $6,000 | 12.00% | $125 |

| Personal Loan | $4,500 | 6.00% | $150 |

If Jim just makes the minimum payments for these every month going forward, it’s going to take Jim 5.5 years to get debt free and it’s going to cost him $2,900 in interest.

Jim’s not happy with that and wants to accelerate his debt payoff, so he makes tough trade-offs in his budget and is able to find an extra $200 a month to apply to paying off his loans.

But Jim has no idea where to put that money. Should he pick one debt and apply it there? Distribute it evenly across all three?

This is where Debt Snowball and Debt Avalanche come in.

Debt Snowball

To use the Debt Snowball method, Jim organizes his debts from the smallest balance to the biggest and plans to pay them off in that order.

He’ll make minimum payments on all of his loans but will focus any additional funds on the smallest balance first. In order, he’ll be paying off his personal loan ($4,500), then his auto loan ($5,500), and finally his credit card debt ($6,000).

Focusing on his personal loan first, Jim is able to pay $350 a month (the $150 minimum plus his extra $200). He keeps his resolve and after 14 months, he gets an awesome reward - he crosses his first loan off the list!

Now the snowball is growing. With the personal loan gone, Jim has an extra $350 a month he can apply to his auto loan. This bumps his monthly payment from $200 to $550. Despite the size of the loan, he’s able to knock it out just 5 months later.

Now Jim’s just got his credit card debt left, but he’s got an extra $550 a month he can apply there. He’s now making monthly $675 payments instead of just $125 and he’s crushing it. In just 8 more months, he kills the last of his debt and has a beer to celebrate.

Using Debt Snowball, Jim was able to pay off all of his debt in 2 years and 3 months and spent $1600 in interest payments. By maintaining his discipline, he saved 3.25 years of debt slavery and $1300 in interest.

While Debt Snowball is really good at getting rid of debt, it’s not the optimal method. The optimal method is one that minimizes interest paid; we call this one the Debt Avalanche.

Debt Avalanche

To use the Debt Avalanche method, Jim organizes his debts from the highest interest loan to the smallest and plans to pay them off in that order.

He’ll make minimum payments on each but will focus any additional funds on the highest interest first. In order, he’ll be paying off his credit card debt (12%), then his personal loan (6%), and finally his auto loan (4%).

Focusing on his credit card debt first, Jim is able to pay $325 a month toward his balance (the $125 minimum plus his extra $200). He keeps at it and after 21 months, he’s cleared his first loan.

At that point, he takes the $325 a month he had been applying to his credit cards and puts it toward his next highest interest loan - his personal loan. By bumping his monthly payment from $150 to $475, he’s gaining momentum. Despite the size of the loan, he’s able to knock it out just 4 months later.

There’s just the auto loan left at this point, but now Jim’s a pro at this. He takes the $475 a month he had been putting toward his personal loan and applies it toward his car. He’s now making payments of $675 a month instead of just $200 and he quickly finishes his last debt off in just one additional month.

Using Debt Avalanche, Jim was able to pay off his whole debt in 2 years and 2 months and spent $1300 in interest payments. Jim saved 3.33 years of debt slavery and $1600 in interest.

So, Debt Avalanche is clearly better - 1 month of extra freedom and $300 saved.

But that doesn’t mean that everyone should use the Debt Avalanche method. Here’s why:

Where Psychology and Math Meet

Sometimes we’re all a bit too perfectionistic: we reject a “really good” solution because it’s not the “perfect solution”.

What’s perfect in a spreadsheet might not be perfect in our daily life. See, we’re not actually robots (even though some of us dance like them). We’re flawed beings that make mistakes and deviate from our best-laid plans even though we know that ruin lies ahead.

Jim got into debt and is looking to turn things around; the most important factor for his success is his commitment to stick to whatever plan he chooses.

If Jim starts following Debt Avalanche, but gets discouraged after 15 months and gives up, then it’s the wrong plan for him. At that point, Jim is still another 6 months away from paying off his first account and the finish line might seem too far.

Debt Snowball, on the other hand, had Jim pay off his first debt after 14 months. That earlier win might just be the virtual pat on the back that Jim needs to keep his resolve.

Sometimes Really Good Can Be Good Enough

The most powerful lever to paying off debt is that you don’t let up (Tweet this )

With both methods, paying off one debt completely just gives you that much more to pay to the next one.

Whether the snowball grows or the avalanche cascades, you’re still paying things down way faster than with minimum payments.

Remember - even by using the sub-optimal Debt Snowball, Jim paid off his debt in less than half the time of a minimum payment plan and he cut his interest by 45%. Compared to a minimum payment plan, Debt Snowball Jim is a still a rock star and earned that celebratory beer.

Debt Snowball is a really good method for eliminating debt and you should feel really good if you’re using it to eliminate your debt.

If you’re confident in your resolve, you can optimize a bit by switching to Debt Avalanche, but don’t switch if you’re not ready.

Don’t sacrifice success in the pursuit of perfection (Tweet this )

Bonus Round: What If Jim Can Only Pay The Minimums?

You might be thinking that this is all fine and dandy because Jim scrounged up that extra $200 a month. But what if he could only play the minimums?

The good news is that both of these methods can still apply.

Wait, what?

Yep - remember what we said earlier: the most powerful lever in eliminating debt choosing not to let up.

Even with just making minimum payments, eventually, Jim will pay off one of his debts (in this scenario, it happens to be his auto loan after 29 months). The worst thing Jim could do at this point is to take the money he was putting toward that loan and build it back into his normal budget.

Instead, Jim should look at that $200 as the start of his snowball (or avalanche) for the remaining two debts.

Even just doing this saves Jim 2.25 years of being in debt and $540 in interest regardless of which method he chooses.

Debt Snowball vs Debt Avalanche Spreadsheet

Did you know that today (October 17th) is National Spreadsheet Day?

Yes, there’s such a thing and some nerds like me even put it on their calendar. It makes for great blog post inspiration :)

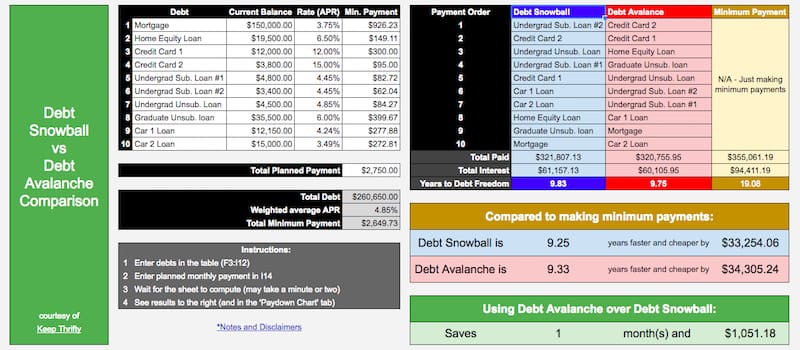

In honor of this wonderful day, I created a spreadsheet to show the actual impact of using Debt Avalanche over Debt Snowball - to see how big of a difference the optimal method really makes.

If you’re curious, you can get your own copy on Google Sheets here

Happy number crunching!

Have you paid off some or all of your debt? What does it feel like to earn debt freedom? What approach did you use to get there?