This article contains one or more affiliate links. We only link to things we support and think you could find useful. If you pay for something you clicked on in this article, we may get a commission as a result.

February’s come and gone and I’m another year older. That’s right, it was my birthday month and, as usual, we’ve got lots of updates to share. Let’s take a look at life in the Keep Thrifty family through our February 2018 spending.

Personal Updates

Early in February, Wisconsin got hit with a ton of snow, so we took advantage as best we could - with snowmen and sledding! By the end of the month, we’d hit warm enough temperatures that just about everything has melted, leaving us with the brown landscape of dormant grass and leafless trees.

Personally, I prefer either snow or summer. Jaime prefers summer period :)

Recognizing that free stuff can be the best, we took the girls to the University of Wisconsin Geology Museum. We had a blast looking at the fossils, rocks, and bones of creatures from long ago. The kids especially enjoyed figuring out what types of food each animal ate based on the shape of their teeth and gazing at the fluorescent rocks under UV light.

We also enrolled our kids in swimming lessons this month. We’ve had them in swimming lessons over the summers every year for the last few years but progress always seems slow, so we decided to enroll in ongoing lessons that our friends recommended. We love it! The kids have made more progress in the last month than the would have in an entire summer. I credit the small class sizes (4 swimmers - three of which are our girls) and amazing instructors.

On a personal note, we celebrated Valentine’s day - and my birthday this month. I’m now 36, just a year shy of the “late 30’s”, but I feel younger and healthier than I did this time last year. We started intermittent fasting this month and I lost 3 pounds in 3 weeks - not too shabby!

Speaking of health - I got to do a comprehensive checkup (with great results) as a part of my health check for my new life insurance. My coverage with my old employer is coming to an end so I got the opportunity to act like an adult this month and figure out new insurance for myself. After looking at prices, I went with Haven Life and am really happy with the price of the policy we got. The whole process of estimating insurance needs, picking the right term length, and finding a good provider is pretty interesting, so you may see a blog post here in the near future.

In other news, we bought a bed! If this doesn’t seem noteworthy, it’s probably that you’re not aware that we’ve been sleeping on the floor for the past year. Floor sleeping was one of our fun experiments that Jaime came up with last year after seeing some YouTube videos on the concept. We’ll have a more detailed post on our experiment and why we bought a bed soon. Stay tuned for details :)

Finally, I’m super excited about a new project that I’m working on with Grant from Millennial Money. I can’t give many details yet - we’re still in semi-stealth mode, but it’ll be a web-based app (to start) and we’re both really excited about how it can help people change their lives. You’ll be sure to hear all about it here over the coming months!

Spending Summary

We track our spending using a little tool I made called Thrifty. We’ve been using it for over 2 years and it’s really helped us get a handle on our finances.

The screenshots you see below are straight out of our account in Thrifty. If you like what you see, consider giving it a try yourself. Head over and try it for free

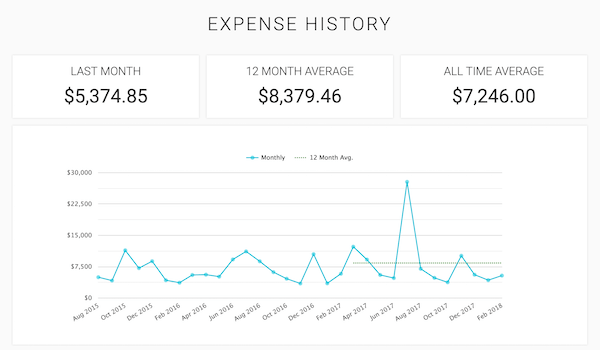

In February, we spent a total of $5,374.85. Our mini-retirement budget for the year is $60,000, so we were a bit over our monthly target of $5,000. That said, the bed made up a big portion of this (almost $1,000) so I think we’re doing fairly well.

Here’s how we’ve been trending on our spending:

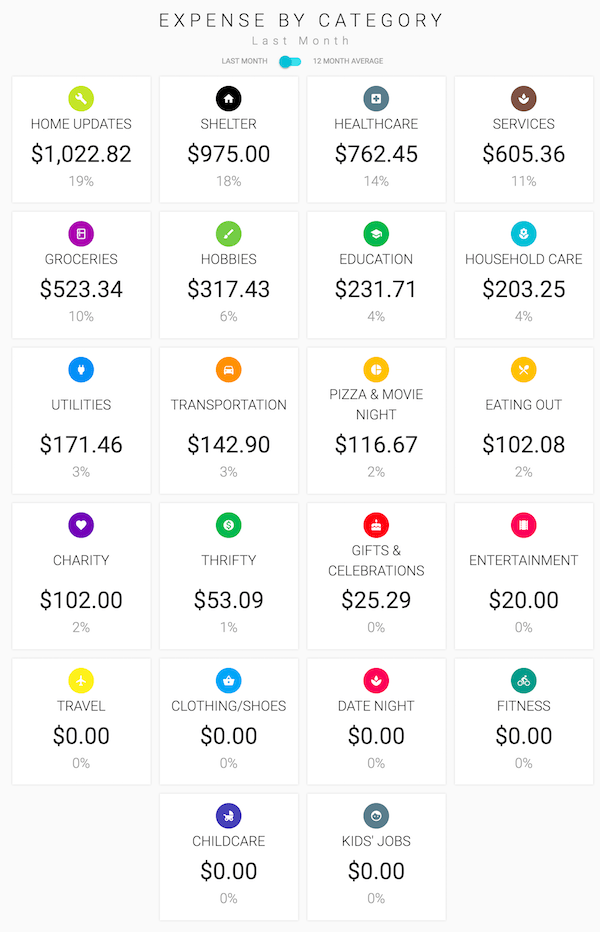

Next, let’s take a look how we spent by category this month:

And here’s a breakdown of each category:

| Category | Amount | Notes |

|---|---|---|

| Charity | $102.00 | We continued our regular contributions to our church and The Hope Effect, one of our favorite charities. We also put a few dollars in a donation box at the UW Geology Museum |

| Eating Out | $102.08 | We had 4 unplanned carry-out meals and two unplanned “treat trips”. Not our best month by far, but we actually did really well on groceries, so I’ll give us a bit of a pass :) |

| Education | $231.71 | This was a month for self-investment. I signed up for an account at Treehouse - an online coding school that I really recommend. Jaime enrolled in a Sketchup Course at a local community college, though it got canceled due to low enrollment. We’ll get a refund on this next month. |

| Entertainment | $20.00 | When we went to the geology museum, we somehow got stuck with a misprinted parking voucher, so we had to pay the $20 “lost ticket” fee on our way out. I’ve debated trying to get it refunded, but the headache and time to do so just don’t honestly seem worth it. |

| Gifts & Celebrations | $25.29 | Happy birthday to me! To keep things simple, the only “gift” I wanted was pizza and ice cream :) |

| Groceries | $523.34 | Holey moley - we’re getting this grocery thing figured out! With the new diet that Jaime and I are on, we’re eating healthy frugal lunches and skipping breakfast, which has helped keep our costs down! |

| Healthcare | $762.45 | Our new health insurance doesn’t have any in-network dentists we like, so we’re paying out-of-pocket for cleanings, etc. Jaime and the girls all got their dental checkups done this month, so we paid a fair amount! In addition, we had all three girls on antibiotics for strep throat and paid for two other office visits from last year. |

| Hobbies | $317.43 | Our new swimming lessons are pricey ($92 per kid per month for a weekly 1/2 hour lesson) but man are they effective. In terms of progress per dollar, these lessons are blowing anything else we’ve done in the past out of the water! In addition, we had some various art supplies that we purchased. |

| Home Updates | $1,022.82 | We bought a bed - including mattress, frame, sheets, and mattress protector. More details in a future post :) I also paid for some supplies to repair our bathroom sink. I know it’s technically the landlord’s responsibility, but it was a cheap fix and it got done faster with me doing it… |

| Household Care | $203.25 | Laundry supplies, moisturizer, household cleaners, pregnancy tests (negative), toilet paper, tissues, a scale for our bathroom, replacement caps for our girls’ water bottles, conditioner, and body wash. |

| Pizza & Movie Night | $116.67 | Our Friday night family tradition continues. We had more “extras” during our four pizza nights this month (read: breadsticks and ice cream), which led to this being a bit higher than our target.. |

| Services | $605.36 | I’m doing a deep dive into the services category this month. See below for more info. |

| Shelter | $975.00 | Rent for our 1150 square-foot apartment |

| Thrifty | $53.09 | Business expenses - app hosting fees for Thrifty, and our email management tool (we use ConvertKit). In addition, I paid for parking our van during my meeting with Grant in downtown Madison. |

| Transportation | $142.90 | We used three tanks of gas this month and got our miserably salty car washed. It’s clean and shiny now! |

| Utilities | $171.46 | Internet and gas/electric |

| Total | $5,374.85 |

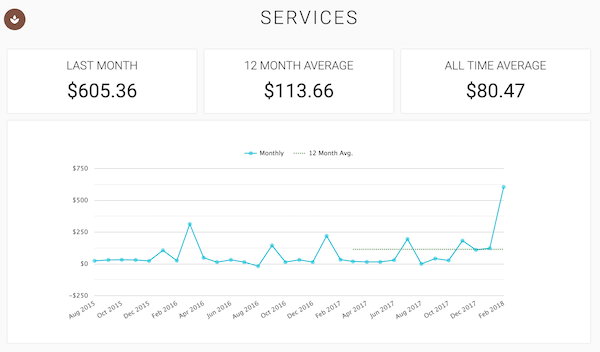

Other than the bed purchase, our most interesting category this month was probably Services due to the variety of “one-off” expenses. Let’s dive a bit deeper:

Spending Deep Dive: Services

Services is a bit of a “miscellaneous” category for us - typically including haircuts, postage, and life insurance payments, among other items.

Here’s how our services spending has trended over time:

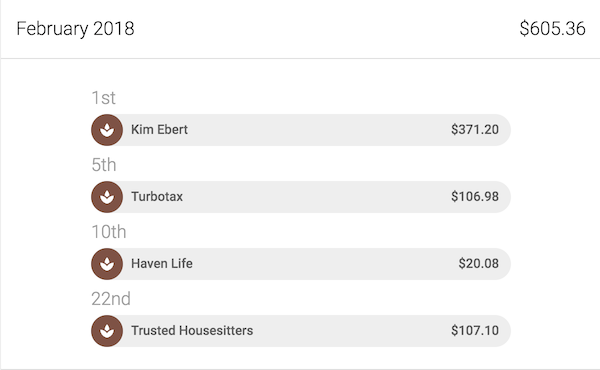

And here’s what we spent on this month:

Our four service expenses this month were:

- Paying for the rest of our Hawaii family photos (we had put down a $100 deposit before the trip). Our photographer, Kim Ebert, did an amazing job. She made the whole process fun and the pictures turned out great!

- Filing for taxes with Turbotax. We’ve used Turbotax for over 10 years and have been happy with the filing process. I feel connected enough to the numbers without having to do all the math by hand :)

- The first premium for my new life insurance policy through Haven Life. Overall, the process was quick and easy and I’m really happy with the price we got on our policy!

- An account with Trusted Housesitters. We’ve heard of Trusted Housesitters from a few other bloggers and sources and decided to dive in and look into the housesitting lifestyle. We’re looking at extending the mini-retirement and being able to spend some time caring for other peoples’ houses and animals while traveling and seeing different parts of the world sounds amazing. There’s a fee to get started, but it was definitely worth it for us to check things out.

That’s all!

I hope you had a great February. We’re looking forward to a (hopefully) warmer and sunnier March!